Banner Life Insurance Review for 2025

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

UPDATED: Feb 24, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Feb 24, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

What’s New in 2021 for Banner Life Insurance

How Has Covid-19 Affected Banner Life Insurance?

In response to Covid-19, Banner Life Insurance’s global brand, Legal and General America, issued a statement that assured its customers that they would continue to receive protection and financial support. The company also introduced a digital platform that allows customers to complete their applications online.

Additionally, as Covid-19 progressed, the company extended its grace period to 90 days of coverage for premiums due from March 15th through July 31st. Furthermore, more cases can now be underwritten, approved, and issued thanks to a revision of the company’s temporary guidelines.

Banner Life Insurance’s TIAA form now includes a Covid-19-related question as well.

Although Banner Life Insurance’s business operations were not affected by Covid-19, its leadership team ensured that its employees were operating according to CDC guidelines.

Enter your ZIP code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

New Products or Changes

Aside from changes made due to Covid-19, Banner Life Insurance has not introduced new products or changes in the recent year.

Banner Life Insurance In The News

Banner Life Insurance was not mentioned in the news in the past year. However, Sarah Bennet, the Vice President and Head of U.S. Marketing at Legal and General America, did discuss marketing and life insurance with HumanAPI.

2021 Latest Banner Life Insurance Reviews

Banner Life Insurance offers affordable life insurance that provides financial protection to its customers. The company offers various policies, including term life insurance, which offers its customers the lowest initial price, and permanent life insurance, which provides long-term coverage.

U.S. News recently issued a review of Banner Life Insurance in March of 2021. In its review, Banner Life Insurance received 4.1 out of 5 stars and ranked fourth in Best Life Insurance Companies of 2021. It also ranked first in Most Affordable Life Insurance Companies of 2021, largely due to its affordable monthly costs.

It should be noted that Banner Life Insurance’s coverage does differ from state to state, although it is easy to apply, and some products are available to those with terminal illnesses. Additionally, U.S. News shared that Banner Life’s term insurance plan, OPTerm, is the most useful of its plans.

The Better Business Bureau (BBB) rated Banner Life Insurance with an A+ rating, though the company is not BBB accredited.

Furthermore, ValuePenguin, a company that provides information regarding customer spending decisions, rated Banner Life Insurance 4.5 out of 5 stars for its “low rates, favorable underwriting, and a variety of coverage options.”

My review of Banner Life Insurance Company is a real eye-opener.

Life insurance is one of the most important financial decisions you will make in your lifetime. That’s why it’s SO important to find out as much information as you can about the life insurance companies you’re considering BEFORE you commit!

If you’re considering Banner Life as a potential life insurer, we have all the answers you need.

Dive into this comprehensive review of one of the best-known companies in the industry to get the inside scoop.

Table of Contents:

Enter your ZIP code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

History of Banner Life Insurance Company

Banner Life Insurance Co can trace its origins back to Great Britain in 1836. Six well-known lawyers gathered in London, England to form a life insurance company, which came to be known as Legal & General Group Plc, Banner Life’s parent company. Legal and General went on to purchase Geico (Government Employees Life Insurance Company) in 1981, which became Banner Life Insurance Company in 1983.

Banner Life was licensed to sell products in every state in the US, with the exception of New York. To solve this issue, William Penn Life Insurance joined the Legal and General group in 1989 and now provides services to New York.

RELATED: 5 Critical Tips You Must Know Before Buying Life Insurance

Legal and General, a multinational insurance company, has its headquarters in London, England. They also have operations in the United States, U.K., Egypt, France, Germany, India and the Netherlands. The home office for BannerLife is located in Urbana, Maryland.

Banner Life uses independent life insurance agents to sell its products and presently, there are approximately 70,000 active brokers on their books.

Banner

Banner Life provides both Term and Permanent life insurance policies and riders.

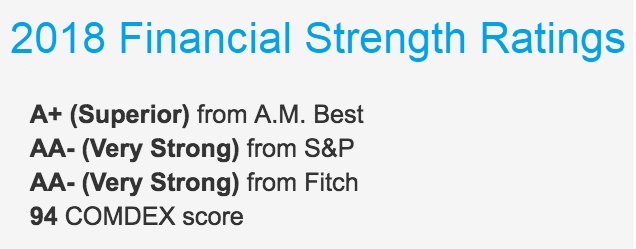

Banner Life Insurance Company Ratings – Financial

Banner Life Insurance Company Ratings are an exceedingly strong and show a financially sound life insurer.

They currently have about 1,140,000 U.S. customers and in 2015, Banner Life sold over $50.1 billion in new coverage. This makes it the 5th best seller of life insurance products in the country!

The parent company, Legal and General, has approximately $685 billion of life insurance in force and over $7.3 billion in assets. In 2015, they reported a staggering net profit of $150.2 million!

Now, this is quite an accomplishment. To say that Legal and General is financially stable is an understatement

From a business perspective, Banner Life has taken a financially conservative approach with its investment portfolio. It’s highly liquid and well-diversified, carrying 94% investment grade corporate bonds. It also has structured securities and commercial mortgage loans.

How do the financial rating companies view Banner life insurance? In a nutshell, companies such as A.M Best, Standard & Poors, Fitch and COMDEX give them two thumbs up!

Banner insurance Company is backed by an international life insurance powerhouse and is financially solid. You can rest comfortably knowing that Banner Life Ins will be able to honor its claims both now and many years down the road.

Banner Life Insurance Products

The life insurance products offered by Banner Life are similar to those offered by other companies. Banner Life provides both Term and Permanent life insurance policies and riders.

The life insurance policies which Banner promotes include:

- Banner Term life insurance

- Universal Life

- Annuities

- Banner Whole Life Insurance

Let’s look at what they specifically offer in more detail.

Banner Term Life Insurance

BannerLife term policies are both convertible and renewable. The term policies are for 10, 15, 20, 25, and 30 years. They also offer no-medical exam policies.

Here is a PDF of their client brochure for 20 and 30-year term insurance.

Banner Universal Life Insurance

Banner Universal life insurance products are some of the most versatile available in the market. These policies give you a great deal more flexibility in terms of how you pay your premiums and additionally, you can adjust the amount of death benefits you need.

RELATED: Check Sample Life Insurance Rates by Age (No Personal Info Required)

Of course, it follows that Universal policies cost much more than term because they provide lifetime coverage, death benefits, and guaranteed cash value accumulation.

Here’s a PDF of the Client Brochure for Banner Life’s “Life Step UL”

Banner Specific Policy Features

Banner Life Ins has a variety of different features to enhance your coverage which include:

- Waiver of Premium: If you become totally disabled or suffer from either an injury or long term illness, the company will waive all premiums during the period of disability. All you have to do is provide proof of a disability that will last at least 6 months.

- Policy Conversion: This feature applies to term only and allows you to convert your policy to a Universal policy at any time during the period of the guaranteed level premium, up to age 70. The underwriting class will remain the same for your existing term. Clients who buy their policies when they are 66 and older can convert them within the first 5 years.

- Flexible Premium Payments: Banner allows you to choose how you pay your premiums. This can be annually, semi-annually, quarterly or monthly.

Available Term Riders

Banner Insurance Company offers a limited number of riders. A rider is simply a separate form of coverage which you buy in addition to your main policy.

The riders which BannerLife sells include:

Accelerated Death Benefit Rider: This allows you to receive up to 75% of your death benefit or $500,000, whichever is the lesser amount, should you incur a terminal illness. As we all know illness is expensive and this can help you in the event of unanticipated medical care.

NOTE: Death benefits are reduced by any amount used and subject to interest.

Children’s Rider: This rider will provide life insurance protection for your children up to age 25, the 65th birthday of the insured or until termination of the policy.

Banner

Banner Life provides both Term and Permanent life insurance policies and riders.

Enter your ZIP code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

A Comparison of Banner Insurance Company Underwriting

One of the best ways to determine if a life insurance company is right for you is to look at how their underwriters view applicants.

To give you some insight into Banner Insurance Company underwriting guidelines, I’m going to compare their approach to 2 other companies randomly chosen.

For this review, I used the guidelines for Banner Life Ins, American General Life Insurance and Principal Life Insurance for a client with a “Preferred Plus” rating seeking term life insurance.

Let’s take a moment to review what factors the underwriters use to make their determinations. The following 5 categories are assessed for each applicant:

- Height/Weight Build

- Smoking

- Blood Pressure

- Cholesterol Levels

- Family History

So let’s see how Banner Life compares!

Banner Life Insurance Co

- Height/Weight Build: A 5’ 11’ person cannot weigh more than 201 pounds for a male and 175 pounds for a female

- Smoking: No use of nicotine or nicotine-based products for the last 36 months. One cigar allowed per month with HO specimen negative for cotinine.

- Blood Pressure: Must be well controlled with or without treatment and the average readings in the past 2 years cannot be greater than 136/86.

- Cholesterol Levels: Must be 120-300 with or without treatment. May not exceed 4.5 with or without treatment.

- Family History: There must be no cardiovascular disease in either parent or siblings before age 60. CAD is disregarded for applicants over age 70 that don’t use tobacco. Cancer is no longer a factor preventing consideration for preferred classes.

American General Life Insurance

- Height/Weight Build: A 5’ 11’ male must weigh between 134 – 211 pounds. A female must weigh between 120 – 208 pounds.

- Smoking: No tobacco for 5 years.

- Blood Pressure: Maximum blood pressure ages 0 – 60 (140/85) – age 61 Plus (150/85). Blood pressure treatment must be successful.

- Cholesterol Levels: Maximum cholesterol ratio, if treated < 5.0 – 215 If Ratio < 4.5 – 290

- Family History: No coronary artery disease or cancer prior to age 60 (parents only).

Note – Ignore family history if proposed insured is age 65 or greater, and ignore gender-specific cancers at all ages.

Principal Life Insurance

- Height/Weight Build: Ages 18 – 44 (126 – 208 pounds) Ages 45 – 60 (126 – 212 pounds)

- Smoking: No tobacco use for 2 years ages 20 – 70; no tobacco use for 3 years ages 71 – 85. The exception is 12 or fewer cigars per year with negative urine.

- Blood Pressure: Cannot exceed 140/85 for ages 20 -44, 40/90 for ages 45 – 64, 145/90 for ages 65 -85

- Cholesterol Levels: Ages 20 – 64 total cholesterol cannot exceed 270 or cholesterol/HDL of 5.5, ages 65 – 85 total cholesterol cannot exceed 280 or cholesterol/HDL of 6.0

- Family History: Will take into account if there was a death of family member prior to age 60 due to breast cancer, colon cancer, ovarian cancer, prostate cancer, diabetes. Family is not considered for applicants over age 71

Pre-Existing Conditions

Banner life insurance Life Insurance Company has very lenient underwriting guidelines. If you have minor or even major health issues, then this is a great company to consider. BannerLife is superb for those with pre-existing conditions such as:

- Diabetes

- Cholesterol and Blood Pressure

- Weight Issues

- Asthma

- Epilepsy

- Anxiety and Depression

- Sleep Apnea

- Atrial Fibrillation

- Unfavorable Family History

- Some Skin Cancers

- Osteoporosis

NOTE: Banner Life is also considered to have very lenient underwriting when it comes to seniors.

Banner Life Insurance Quote, Pricing & Premiums

Let’s run through some numbers for Banner Life Insurance Quote to show you how they compare with the companies I used above.

All quotes are for non-smoking males and females, age 35 with a “preferred plus” rating. These figures are for a 20-year term policy with $500,000 in coverage.

Premiums quoted are monthly and annual.

How Do Banner Life Insurance Rates Compare to Other Providers?

All quotes generated by Term 4 Sale:

Males:

- Banner Insurance Company: $22.75 monthly – $259.99 annual

- American General Life Insurance: $21.97 monthly – $259.99 annual

- Principal Life Insurance: $22.75 monthly – $260.00 annual

Females:

- Banner Life Ins: $19.36 monthly – $221.25 annual

- American General Life Insurance: $20.24 monthly – $234.00 annual

- Principal Life Insurance: $20.83 monthly – $238.00 annual

Banner Life Insurance Co

If you have minor or even major health issues, then BannerLife is a great company to consider.

Is Banner Life a Good Option?

Based on its products, underwriting criteria, and premium costs, Banner Life stands out as a leading life insurer.

If you happen to have a pre-existing medical condition you will be especially happy to hear that this company has some of the most lenient underwriting criteria in regard to multiple health issues.

What a package!

Not only is Banner Life Ins a financially strong and solid company, but they provide some of the most affordable quotes in the business, especially for women.

If you are looking for an affordable policy from a fantastic company, Banner Life Insurance Company is a great place to start. This venerable company consistently comes up in the list of the top 5 – 10 life insurers with the lowest term rates.

Enter your ZIP code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.