7 Alternatives to a 401k

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

UPDATED: Dec 4, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Dec 4, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

I’m not a fan of whole life insurance. But since I continue to hear this absurdity that whole life is the only good option for individuals who are maxing out their 401k and IRA, I brought the financial experts with me in this post.

Whole life is not your only investment option if you’re maxing out your 401k or can’t contribute to an IRA. Especially if you don’t even need life insurance!

Please consider the following prior to spending a penny on whole life insurance!

401k Alternatives to Consider Before Whole Life

If you haven’t already done so, I would first go to a CFP and offer them a fee to look at your entire financial plan before speaking to any agents about whole life.

Remember commissioned salespeople generally make for horrible financial advisors since they’re hopelessly biased toward selling their OWN product first.

CFP’s, such as those at AIO Financial, are not only responsible but have a fiduciary duty to tell you what’s best for YOU.

I’m most comfortable recommending fee-only ones since they aren’t compensated by which investment you choose.

Here are a few alternate investment ideas I would discuss with a CFP.

(Note: These are written for a W2 Employee in mind.)

RELATED: 5 Critical Tips You Must Know Before Buying Life Insurance

#1 – Taxable Account

Multiple personal finance experts like Larry Ludwig from Investor Junkie and Eric McClain from McClain Lovejoy Financial Planning will tell you a regular taxable brokerage account is one of your best options.

With long term capital gains at just 20%, this option provides liquidity and flexibility (you can take it out whenever you want) and low expenses.

CFP and NerdWallet contributor Adam Funk, from SavingsCoach.com, says:

Sophisticated investors don’t shy away from taxable accounts. For example, you’ll see them buy and hold Warren Buffett’s Berkshire Hathaway stock for years. It’s liquid if necessary and they don’t pay dividends, so they’re only on the hook for low, long term capital gains tax when/if they sell.

If you’re wondering how a taxable account could possibly measure up to a tax haven like whole life insurance, it’s probably because you’re focusing solely on the tax benefits of whole life.

In reality, the tax benefits aren’t that great considering most people don’t even break even for the first 10 years in whole life. What good is tax-free access to funds that have no gains?

Plus, you shouldn’t just be considering tax benefits.

Todd Tresidder from Financial Mentor says,

It all comes down to mathematical expectancy or net ROI after tax. The fact that an investment has tax benefits is great, but that’s only one aspect of performance! Say a stock is 100% taxable in a non-qualified account, but it has a 50% return. Its ROI is still incredible. That’s why if you’re simply considering the tax benefits of whole life insurance, you’re taking your eye off the ball.

My personal opinion (if you’re not good at valuing companies) is to just invest in a handful of ETF’s that track the major indexes like the S&P 500 (IVV), the Aggregate Bond Index (AGG), and the MSCI Emerging Markets Index (EEM), among others.

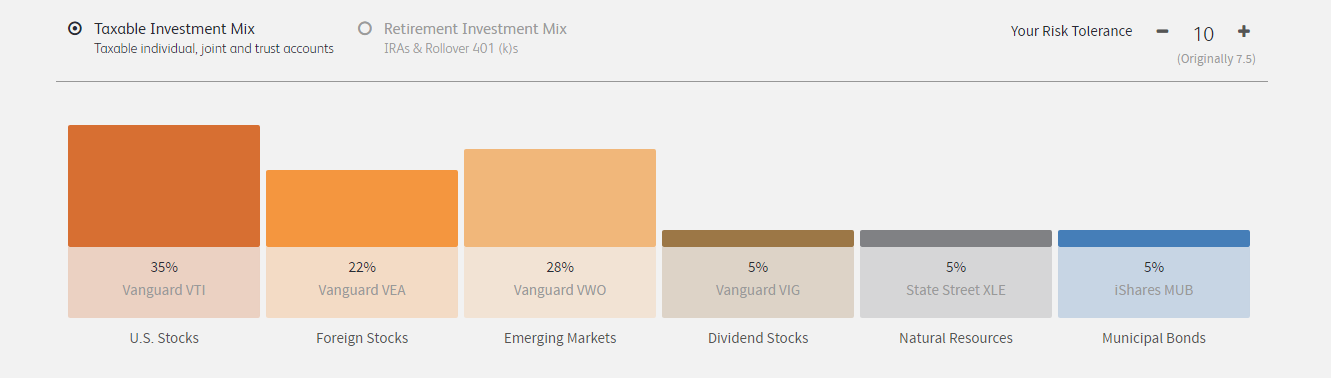

You could simply fill out a risk assessment form on a site like WealthFront and instantly see (and mirror) the strategy they would put you in.

This way you don’t have to do any stock picking. But it would be wise to enlist the help of a Financial Planner or RIA here to help you take advantage of things like loss harvesting and rebalancing your portfolio.

#2 – HSA Account

If you have a high-deductible health insurance plan, an HSA is an excellent place to invest for your retirement.

Roger Wohlner from The Chicago Financial Planner and author of “Health Savings Accounts – The Other Retirement Plan” says you can contribute to an HSA with pre-tax money, similar to an IRA, and withdraw the money for qualified medical expenses tax-free.

You can contribute $3,350 as an individual or $6,750 as a family in 2016, as well as an additional $1,000 “catch-up” contribution if you’re over age 55.

The best part?

There’s no maximum income that disqualifies you from contributing.

Qualified healthcare expenses include:

- long term care expenses

- Medicare & Medicare supplement premiums

- most medical and dental expenses

- vision care

- co-insurance and deductibles

- prescription drugs

Wohlner says that even though the funds must be used for medical expenses, it’s highly likely you will use them, citing a Fidelity study, which estimated that an average 65 year old couple will spend over $245,000 in health expenses throughout retirement.

RELATED: Check Sample Life Insurance Rates by Age (No Personal Info Required)

#3 Variable Annuity

Variable annuities offer tax-deferred growth but are taxed at ordinary income upon withdrawal. I’m told Vanguard has a good, low cost one.

But VA’s do have one very nice feature:

- Annuitization

The cool thing about annuities is you can “annuitize” them, meaning you can take your income out over a fixed period of years, say, 10, 15, or 20 years.

The benefit here is any taxable gains you’ve made over the years doesn’t hit you all in the first few years of distributions as you pull out those gains.

Instead, the gains are spread out over the time period you’re taking the money.

For example, if $500K of contributions turn into $1 million, and you take it all out at once, you’ll owe tax on a 500K gain. But you could take the $1 million over 20 years, so only about half of the income from it would be taxable.

#4 Rental Property

Elizabeth Colegrove from The Reluctant Landlord teaches investors how to add rental properties to their asset portfolios.

Colegrove says that besides the equity you can gain from owning a rental, there are several other benefits of being a landlord including:

- Positive cash flow

- Tax deductions – You can depreciate your rental

- 1031 exchange – Time to sell your rental? That doesn’t mean you have to pay taxes on your gains yet. You can roll your money into a new property using a 1031 exchange.

Real estate offers lots of tax breaks and potential diversification of your asset portfolio.

If you’re too anxious for owning a rental, you might try investing in REITs. REITs allow you some of the same benefits without owning the property.

#5 US I Bonds or EE Bonds

Larry Ludwig from Investor Junkie said another way to add safety to your portfolio and get some tax benefits was using US I Bonds or EE Bonds.

I Bonds earn interest based on a combined fixed rate and inflation rate. EE Bonds just earn a fixed rate.

They’re both STATE tax free but not Federal. You may be able to use them for higher education and avoid federal income tax too.

#6 Non-Deductible IRA with Conversion to Roth

This idea was first proposed to me by Eric McClain from McClain Lovejoy Financial Planning.

McClain says if you make too much to contribute to a Roth, consider making contributions to a non-deductible IRA. Writing for FiGuide.com, McClain says:

Later, you can convert these non-deductible contributions to a Roth account but would not pay tax on the “basis” contributions. This strategy is often referred to as a “backdoor” Roth contribution.

In other words, you can contribute today to an IRA (even if you make too much to contribute to a Roth), wait a few days or a few weeks, and then convert to a Roth. Kimberly Lankford at Kiplinger says you’ll only pay tax on the gains you made while the funds were in the IRA.

McClain and Lankford both stress that the tax treatment of Roth conversions becomes much trickier when some of the IRA funds being transferred were “pre-tax” contributions, and urge you to speak with a tax professional before making any moves.

#7 Invest in Yourself

An excellent way to invest your money and get tax benefits is to start your own business.

A business enjoys tax breaks on phone, home office, mileage, etc.

I recommend working in a business where “anyone” could be your client. For example, just about everyone I know is either a life insurance client of mine or a prospect. That makes for a lot of deductible meals.

If starting a business intimidates you, get started in a network marketing company!

All the product development, branding, and marketing are done for you. All you have to do is share with your friends and family.

It’s super low cost and the tax benefits are tremendous.

Get Advice on Your 401k Alternatives

Disclaimer: I am not a financial planner.

This is not to be considered investment advice, only considerations that may be better than whole life.

I recommend speaking to a CFP before making any investment decisions.)

Enter your ZIP code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.