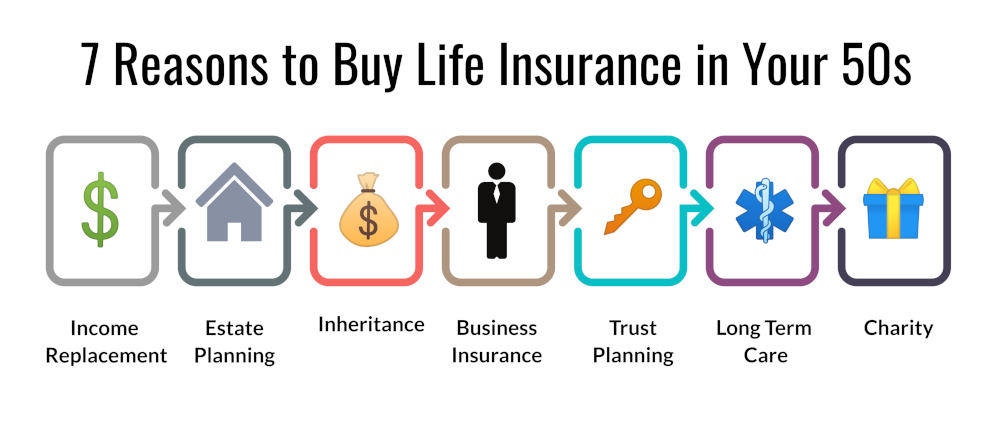

2. Whole Life Insurance & Guaranteed Universal Life Insurance

Some 50 year olds need a more permanent answer.

Perhaps you are receiving or planning to receive a pension or social security that does not have survivor benefits and your spouse will depend on that income. Term won’t work here.

For others, you may just want to leave an inheritance to your spouse or children, so your life insurance needs have nothing to do with income replacement. In those cases, you need permanent

coverage.

There are also those affluent families and individuals who have sizeable estates, who need life insurance to pay estate taxes to Uncle Sam. That situation also calls for a permanent solution.

In all these examples, I recommend a policy that will cover you for your whole life called guaranteed universal life to age 120, which is very similar to a term life policy for the rest of your life. You get the lowest cost without any cash value build-up. In our quote box, just choose the lifetime option.

We do not sell whole life insurance.