Life Insurance for 70 to 75 Year Olds

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

UPDATED: Dec 4, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Dec 4, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

We know it can be difficult to search for life insurance in your seventies.

It might seem like all the affordable policies are no longer available, or that you can no longer qualify due to health concerns.

We can help! We specialize in finding affordable term and whole life insurance coverage for ages 70 through 75 years old.

Table of Contents:

Is 70 Too Late for Life Insurance?

No!

At this age, many policy options are still available, including 10 and 15 year term life insurance. Permanent policies such as whole life or universal life insurance coverage are available as well.

Let’s take a look at the cost of life insurance for 70 to 75 year olds, as well as the best policy options available for seniors over 70.

Enter your ZIP code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

Cost of Life Insurance for Ages 70 to 75

Here are some average premium rates for ages 70 to 75:

Term Life Insurance Rates for 70 – 75 Year Olds

These rates are for a 10 year term life insurance policy at age 70 -75:

| AGE | $100,000 | $250,000 | $500,000 |

|---|---|---|---|

| 70 Year Old Male | $96.74 | $212.50 | $413.69 |

| 71 Year Old Male | $105.10 | $235.34 | $455.45 |

| 72 Year Old Male | $114.93 | $262.52 | $506.34 |

| 73 Year Old Male | $126.15 | $293.63 | $566.81 |

| 74 Year Old Male | $138.50 | $327.56 | 636.84 |

| 75 Year Old Male | $151.29 | $363.01 | $712.97 |

Guaranteed Universal Life Insurance Rates for Age 70 & 75

Here are some sample quotes for a GUL policy with up to $1 million dollars in coverage:

| Age | $100,000 | $250,000 | $500,000 | $1,000,000 |

|---|---|---|---|---|

| 70 Year Old Male | $3,065 | $7,170 | $13,925 | $27,000 |

| 75 Year Old Male | $4,115 | $9,695 | $19,230 | $38,125 |

*The quotes above are based on a healthy male, who would qualify for a “Preferred Non-Smoker” Rating.

What is the Best Type of Life Insurance After 70?

For most individuals over age 70, a “Lifetime Guaranteed” policy like Guaranteed Universal Life Insurance is the best option.

Guaranteed universal life insurance, a type of permanent coverage, is essentially a term policy that covers you for the rest of your life, but without all the cash value build-up that you get with a whole life policy.

Reasons to Consider Guaranteed Universal Life after 70:

- Offers guaranteed level premiums for life

- Face value (death benefit) is guaranteed never to decrease

- Half the cost of whole life, on average

If you’d like to see free pricing for a guaranteed universal life insurance quote, click below and select “Lifetime” from the Duration option.

Term insurance is mostly purchased by young adults to replace income lost in the event of their death.

Most people who need life insurance over the age of 70 don’t need it for income replacement. They need it for the rest of their lives. That’s why I recommend a permanent policy.

Is Term Life Insurance Available After Age 70?

Yes! I get a lot of clients age 70 and older who only want term insurance.

If you have a short term need, such as 10 or 15 years, term insurance offers you low, level premiums during the duration of the term.

Here are the benefits of a term policy for seniors over 70:

- Simple, straight forward coverage – There’s no cash value or investment component. Coverage is simple. If you pay your premiums on time, you’re covered.

- Level premiums – Your premiums are guaranteed to stay fixed during the duration of the term you select, such as 10 or 15 years

- Low cost – Usually half the cost of a lifetime policy

However, term policies only offer coverage for 10-15 years in your 70’s, which may not be best for many people.

It makes sense for them to purchase term coverage as long as they are only going to need the coverage for another 10 to 15 years.

Recent age limits have been placed on term policies, however.

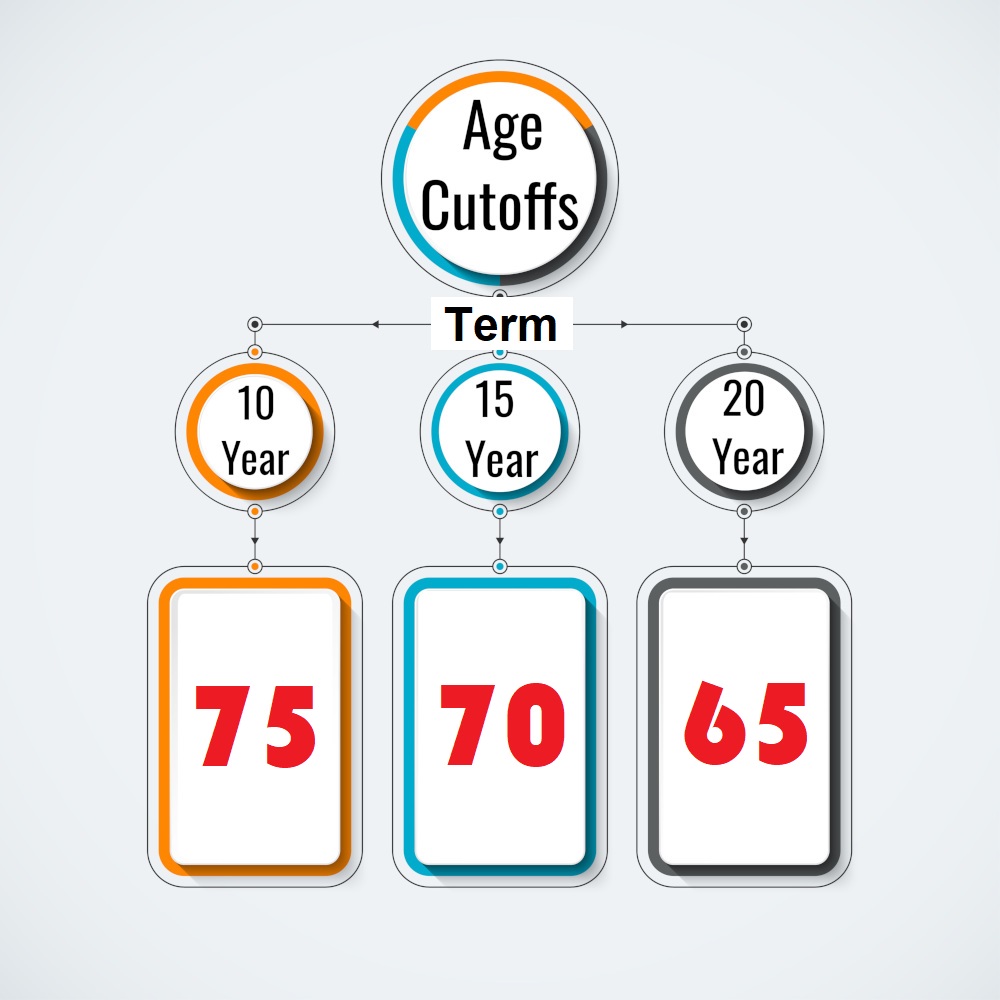

What Are the Age Limits for Term Life Policies?

For example, here are Protective’s Age Limits.

- 10 year plan: 18-75

- 15 year plan: 18-70

- 20 year plan: 18-65

As you can see, 75 year olds can still buy 10 year term, but cannot qualify for a 15 year plan.

In the past, from age 76 to 80, you could get a traditional 10-15 year term policy and could get a 10 year term policy all the way up to age 85.

Now, however, the age limits have come down, so you can’t get a plain vanilla term policy at these older ages. If you need coverage for a limited time period, you can still do so with a guaranteed universal life insurance policy set with guarantees to age 90 or 95.

At any of these ages, you can still apply for permanent policies like guaranteed universal life insurance to age 120, which I prefer.

Enter your ZIP code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

Do You Take Medication or Have a Pre-Existing Condition?

If you’re a typical 70 to 75 year old, you will have some medical conditions or may take medications for blood pressure, cholesterol, or have a detailed medical history.

This is where our service stands above the rest. We specialize in high risk life insurance cases!

We’ve helped hundreds of individuals purchase life insurance who took medications for various conditions or had a history of heart disease, cancer, or diabetes. Here are just a couple examples:

- We were able to help a 73 year old female qualify for a Standard rating with diabetes.

- A 74 year old man recently qualified for a Standard policy with us who had a history of prostate cancer.

Approval Tips for Seniors over 70

The most important thing you can do is… STAY AWAY FROM CAPTIVE INSURANCE AGENTS!

Say you’re 74 year old female and have a history of high cholesterol, and once had a stroke. If you go to an agency like Farmer’s or State Farm, most likely they’re going to sell you a Farmer’s or State Farm policy… even though those companies penalize you severely for having a stroke.

If you use an “independent agent”, your agent can shop around for the company who would be fairest and charge the least with your particular history of cholesterol and a stroke.

Using an independent agent can easily save you 50-75% on life insurance.

How to Buy Life Insurance After Age 70

Wondering how to purchase life insurance after age 70? In most cases, this will be the process:

- Get Your Best Quote

- Apply for coverage – a simple process, which can be done by phone

- Take a free medical exam

- Wait 4-6 weeks for approval

- Pay your first premium, and your policy is now effective

Which Company is Best for 70 – 75 Year Olds?

Think you’re too old? Worried about a medication you take, or a health issue?

AIG Direct is the best place to start. They insure individuals up to 85 years without evidence of insurability requirements.

Have Questions? We can help!

Whether it’s working with a senior over 70 or helping an individual qualify for life insurance with a tough medical issue, our agents have seen it all and can help.

Enter your ZIP code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.