5 Reasons Dave Rasmsey and Suze Orman Are Right – Term is Best!

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

UPDATED: Dec 4, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Dec 4, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Financial gurus Dave Ramsey and Suze Orman say you should only buy guaranteed level term insurance.

They say that permanent insurance policies like whole life insurance are a bad investment.

And why do they care about insurance?

Because the money you don’t spend on the wrong insurance policy is money you can save and use elsewhere!

If you’re comparing term vs whole life insurance, this article will provide you with some helpful tips from Dave, Suze, and myself. There’s a rebellion against whole life insurance, and you should know all the facts before signing up for a permanent life insurance policy.

Let’s discuss the Dave Ramsey & Suze Orman life insurance view and why it may or may not be right for you.

Quick Article Guide: Why 90% of Financial Advisers Say Term Insurance is Best

- Why Buy Term Instead of Whole Life Insurance?

- How to Save up to 30% on Term Life Insurance

- Term vs Whole Life Insurance

- Benefits of Permanent Life Insurance

- When is Whole Life Insurance a Good Idea?

- Term vs. Universal Life

CAUTION: If you’ve gotten a term quote, be sure to check out out these ways to save up to 30% on life insurance to be sure you’re getting the best deal.

Enter your ZIP code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

Term vs. Whole Life Insurance: What’s the Difference?

Here are some of the key differences between term and whole life insurance policies.

Please note that whole life insurance is not the only type of “permanent” or “lifetime” insurance. See our article on universal life insurance.

And now here are 5 reasons Dave Ramsey and Suze Orman will tell you to buy level term life insurance.

#1. Term Life Insurance is Cheaper than Permanent Insurance

Term life insurance is a lot less expensive to buy than a permanent policy. Typically only 5-10% of the cost of whole life.

Dave Ramsey says that if a 30-year-old male had $100 per month to spend on life insurance, he could only afford to purchase a $125,000 whole life insurance policy.

That’s because it’s “permanent life insurance.”

What is permanent life insurance?

It means it’s designed to last to age 100 or longer, and typically includes a cash value component to it, meaning if you cancel at some point, you may get cash back that’s building up in the policy whereas term doesn’t return your premium.

Why is this important?

The same $125,000 coverage on a term life insurance policy would only cost him about $7.00 per month. That’s a savings of $93.00 per month (or $1,116.00 annually) that he could invest or save.

*Sample quotes above are for a male in preferred health, non tobacco, and are not to be construed as an offer for insurance. Prices are subject to change.

The “Dave Ramsey Life Insurance Stance” is Very Bold

In the following video from The Dave Ramsey Show, a fan asked Dave why he recommends term, and what’s the difference between term and whole life.

You can tell that Ramsey gets fired up when he’s asked if whole life is worth it.

A couple notable quotes from this video are:

- “Term doesn’t have any gimmicks or bells or whistles that has an investment built into it.”

- “The lifetime ROI on whole life is around 1% like your stupid savings account at the bank. No one builds wealth at 1%.”

- “Whole life is the payday lender of the middle class.”

Does Suze Orman Agree?

Suze Orman is also of the opinion that permanent life insurance is way over priced when it comes to the actual value you receive for the money you invest in life insurance.

She also believes that it would be much more advantageous to invest the difference between what you would spend for term insurance versus what it cost to buy a permanent policy such as whole life or universal life.

Bottom Line:

The “Suze Orman Life Insurance Stance” would be that everyone should buy term!

#2. “Buy Term Invest the Difference” – The Savings on a Term Policy Can be Invested

Both Dave Ramsey and Suze Orman say that the money you save on a term policy can be better invested elsewhere and earn you a higher rate of investment.

This is generally true.

Most whole life policies won’t break even for the first 7 to 10 years.

Dave Ramsey says that the average rate of return on a whole life policy is just 2.6%.

(On a universal life policy, the average rate of return is 4.2%, and on a variable life insurance policy, the average rate of return is 7.4%.)

On the other hand, according to the Consumer Federation of America, the average rate of return on the same mutual funds which you can invest in outside of a permanent policy is 12%.

So:

Do you think you can outearn 2.6% in the stock market or in real estate?

Probably!

In fact, I recently asked 7 personal finance experts if they had already maxed out their 401k and IRA, and were being pitched whole life, what would be a better investment. Here were their answers.

Term vs. Whole Life Insurance: Suze Orman’s Take

In the following video, Suze Orman shows a 39 year old man who recently bought a 1 million whole life policy what he should do instead.

Like Dave Ramsey’s life insurance views, Orman gets super upset and animated even at the question if you should buy term or whole life.

Suze argues:

- He should cancel the 1M whole life policy Jaimie bought for his wife

- Since it costs 10x as much as term, over 30 years, they could take the $900 savings and probably invest it to make $1 million in their own investments

I’ve run several comparisons on “buying term and investing the rest” vs investing in whole life.

Term wins 99% of the time!

… and if you’re an agent (or your agent is telling you) that whole life is the only good place to get tax breaks besides a 401k or IRA, you need to read about these 7 Investments before you consider whole life.

#3. What Type of Life Insurance Do You Really Need? (Probably Not Whole Life)

Having spoken about the rate of return of the “investment” in whole life and universal life, you might be thinking that the “return” is not important to you because you need lifetime coverage.

Here’s what I say to that…

Very few people actually need permanent coverage.

If you are planning for the future prudently, paying down your debts and investing for the future, most Americans ages 20 to 50 won’t need coverage 20-30 years down the line.

Dave Ramsey addresses this question in the following video.

He argues:

- no one needs anything other than term

- if you’re paying off debt (including using a 15 year mortgage) and investing 15% of your income, you’ll have plenty of savings and have no mortgage when your term ends, so it’s ok when your term expires

I don’t 100% agree with Ramsey here, though, because not everyone invests 15% of their income or gets a 15 year mortgage.

In other words, Ramsey’s advice to buy term might be ok for his followers who live “the Ramsey way”, but what about for other people?

There are a few instances that warrant permanent coverage:

- charitable giving

- estate planning / estate liquidity

- to fund a life insurance trust

Even so, in these cases, we’d recommend you look into Guaranteed Universal Life, not regular universal life or whole life.

Guaranteed Universal life offers permanent protection, but without all the cash build-up, so it runs half the cost or less of whole life.

#4. Permanent Life Insurance Policies Have High Up-Front Expenses

Both Dave Ramsey and Suze Orman also point that it takes several years before you even begin to reap any benefits from a permanent life insurance policy.

This is also true because the entire first year of premiums that you spend on a permanent policy goes to the insurance agent who sold you the policy as commission.

Good for the agent.

…bad for you!

According to Dave Ramsey, it can take up to another additional 2 years of premium payment to account for all the additional expenses.

If you take our earlier example of the savings you would get from a permanent policy and opted for a term policy instead and saved $93.00 per month, which works out to $3,348.00 that you could have saved and invested elsewhere.

#5. Permanent Insurance is Misleading

One of the other irritants about permanent insurance according to both Dave Ramsey and Suze Orman is that the cash value accumulation feature is somewhat misleading. If you buy a $250,000 permanent life insurance policy then that is what your beneficiaries would get when you die.

People get this wrong:

Some people are mistakenly under the impression that you get the face value of the policy PLUS the cash value accumulation feature. This is not the case as both the death benefits and the cash value accumulation feature are joined together for a total of $250,000 and not a cent more.

With all the fees, loans, paid up additions, dividends that make up life insurance, it’s confusing.

If Warren Buffett doesn’t invest in anything he doesn’t understand, you probably shouldn’t either.

Here’s Suze Orman again speaking truth to a caller on her show whose insurance agent “friend” pitched him whole life.

In this video:

- Suze reveals just how much commission his “friend” stands to make off his policy purchase

- What he should do with the money instead

One observation I’d like to add to Suze’s analysis (from a life insurance agent’s perspective) is that just because a broker stands to make a lot of money off a policy, that in and of itself doesn’t make whole life “bad.”

Whole vs Term Case Study: Is Whole Life Really a Bad Investment?

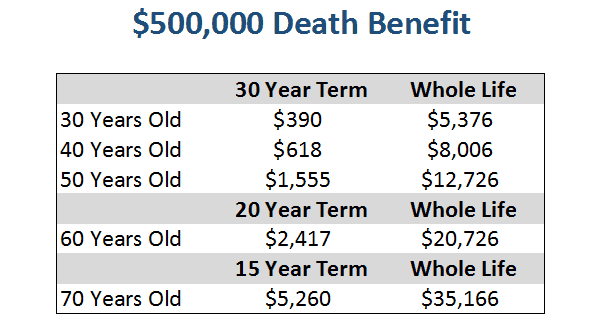

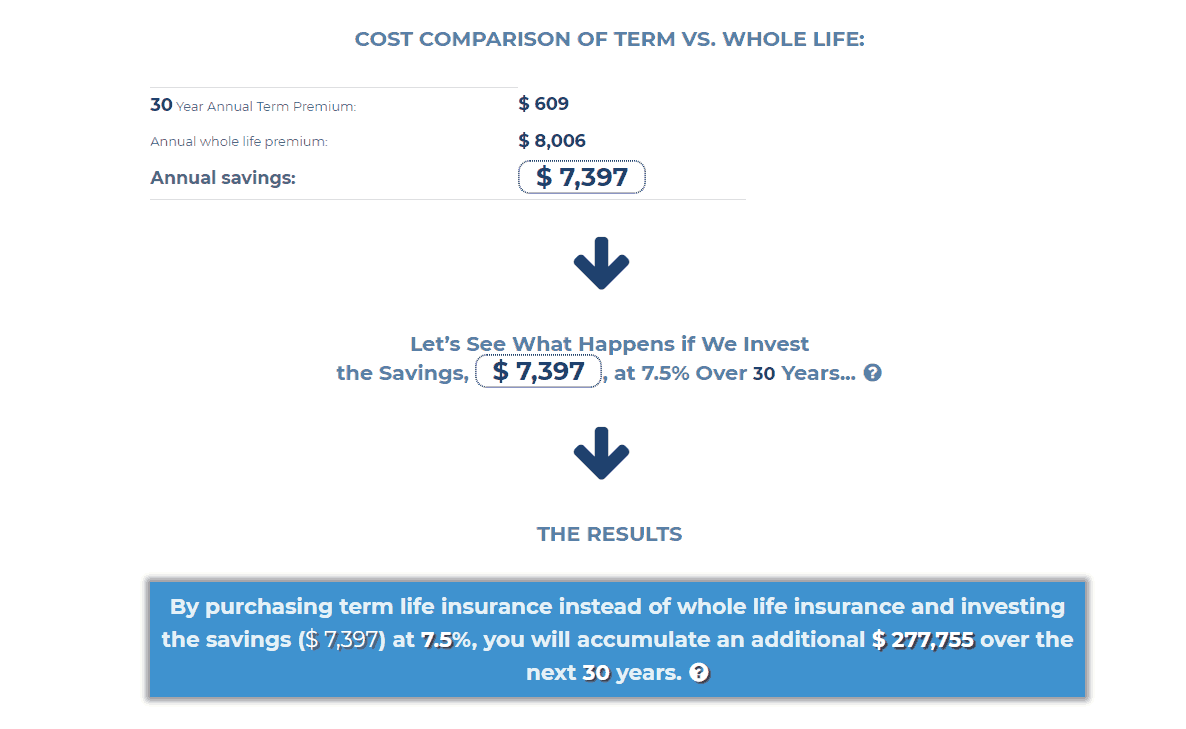

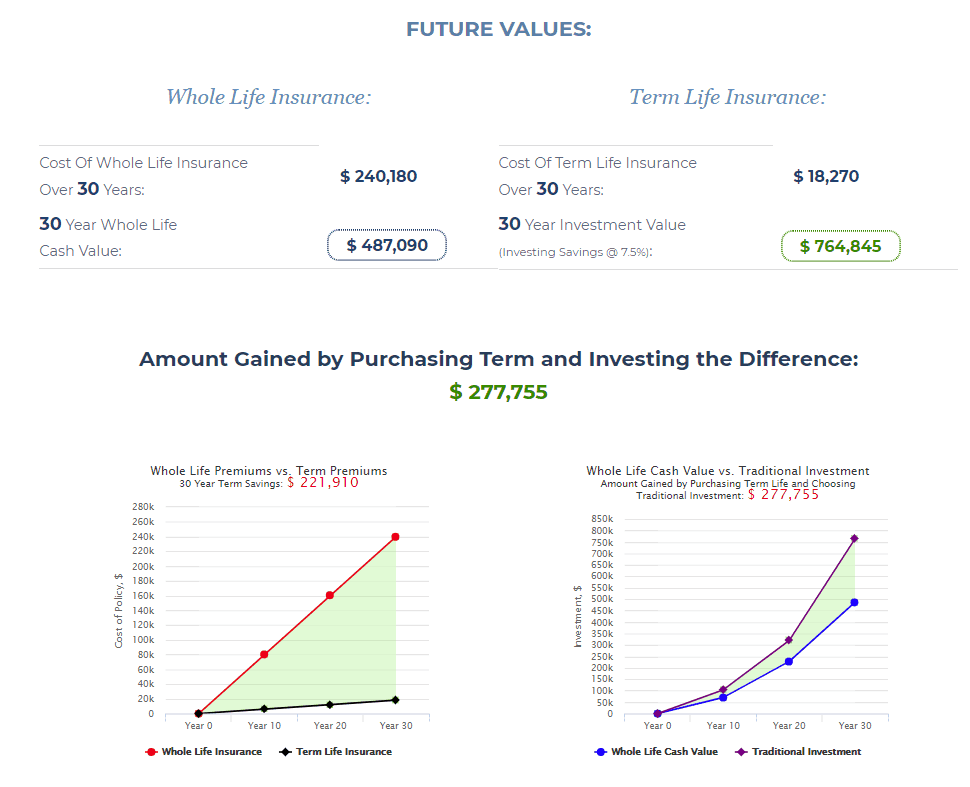

Take a 40 year old male in great health looking for $500,000 of coverage.

Here are his whole and term life quotes (annually):

As you can see, buying term life insurance saves him $7,397 per year.

Next, you can see that if you took that savings and invested it, earning 7.5% average return per year, you’ll make an extra $277,755 OVER and beyond what you’d have in your whole life policy cash value.

Note, this is only for illustrative purposes, and there are some nifty things you can do with your whole life policy during its life, like borrow from it, or use the dividends to pay your premiums, but you should still get the point.

How to Save 30% or More on Term Life Insurance

Here are 2 of the best tips I’ve learned from selling life insurance over the past decade that many other agents don’t know.

Buy 2 Policies Instead of One, and Stagger the Term Lengths

Most agents will try to sell you one big policy with a long term length like 20 or 30 years.

But why pay for a full 20-30 years of coverage for the full amount if you don’t need it that long?

You can save 10-20% by buying 2 policies totaling the same amount of coverage, one with a shorter term and one with a longer term.

If you plan prudently for your future, you won’t need as much coverage in 10-15 years, so let the first policy drop off.

Take an Annuity Payout Over a Lump Sum Payout

You can specify with some carriers to pay the death benefit out over time instead of as a lump sum, and this can save you 10-30%.

For example, your beneficiary might be paid $50,000 per year over 10 years instead of $500,000.

Read all my best life insurance savings tips!

Does Permanent Life Insurance Have Any Benefit?

Yes, permanent insurance does have advantages. Although both Dave Ramsey and Suze Orman do make some valid points, they are not completely correct as permanent insurance does have some advantages. For one thing, many people have difficulty saving money.

Here are some possible benefits:

- It’s a forced “savings plan”

- Provides steady growth a minimum interest rate

- Policy values may be “borrowed” tax free

- Offers lifetime coverage

#1 – The Forced Savings Plan

Somehow, many of us find some other ways to spend the money we should have saved and invested.

If you have problems saving money, then a permanent policy might be ideal for you to save for the future.

#2 – Steady Growth w/ Minimum Interest Rate

Some people have very little savvy when it comes to investing money.

We always hear horror stories of how people have lost their entire life savings in a bad investment. And, we’ve also seen what happened recently with the real estate market. The stock market bounces up and down like a yo-yo.

Permanent insurance may not be the highest yielding investment, but it can provide steady growth and many policies offer a minimum guaranteed rate of return.

#3 – Possible Tax Free Access to Cash

The money you invest in permanent policy can often be retrieved non-taxable as policy loans. Your outside investments are often taxable and that is something both of these financial gurus often neglect to mention.

#4 – Life Insurance to Age 100 or More

The final advantage of a permanent policy is that it guarantees that you are insured for your entire lifetime as opposed to term insurance which covers you for the life of the term. If your health has declined significantly by the time you go to renew, you could be declined coverage and where would that leave you?

More specifically, here are 3 instances when it actually makes good sense.

3 Instances When Whole Life Insurance Makes Sense

You might be thinking by now, “C’mon, millions of people can’t be wrong about whole life. Surely it has its uses…”

And here’s where Ramsey & Orman and I would disagree.

They would probably say, “Never!”

I say there are a few select situations when whole life insurance policies are worth it.

As you can see, it’s not so much a matter of “which is better, term or whole life?” It all depends on your situation.

So…

Why should you buy whole life insurance? Here are 3 great examples.

#1 – Estate planning / Asset Protection

There are instances when not only is permanent life insurance needed to fund an advanced estate planning strategy, but there may also be a need for liquid access to cash values, or the owner (usually wealthy) is enjoying an advanced asset protection strategy – which only works when cash value life insurance is in play.

#2 – Business Planning

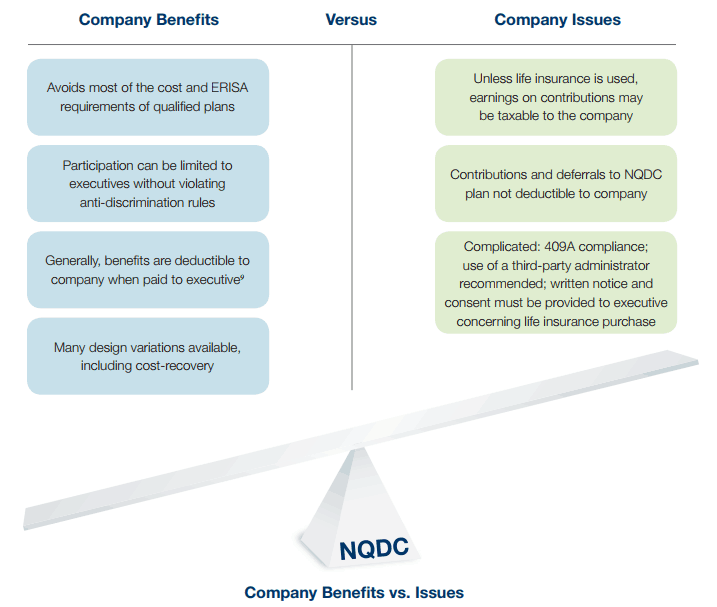

Many businesses use cash value life insurance policies to fund executive compensation and deferred benefit plans, helping them retain key executives.

In this world, the “price” and “policy values” are less important and skewed since both the employer and executive may benefit partially from the policy. Furthermore, one of the most attractive reasons companies use them is because they’re easy to administer and avoid many of the ERISA complications and requirements of administering a qualified plan.

Pacific Life put out a great piece on why you should use whole life to fund company plans, which I’ll post below.

#3 – If an Accredited Investor Wants to Buy It

A few of the biggest concerns about whole life are that it’s confusing, the returns are low, and it’s overpriced.

But if an accredited investor (someone with > $1 million net worth and > $200,000 annual income) were to call us for whole life just looking for a safe place to grow their money conservatively, they’d be perfect for it.

They can afford the premiums and won’t let it lapse like so many do.

Image source: Pacific Life’s Consumer Brochure “The Competitive Edge”

Enter your ZIP code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

Universal Life Insurance vs Term Vs Whole Life

Another type of insurance we mentioned earlier but didn’t discuss was universal life insurance.

Universal life (UL) has variants like variable universal life and indexed universal life, but works somewhat similarly to whole life.

In both cases they:

- may offer lifetime coverage (although in the case of whole life it’s guaranteed)

- both include a cash value account

- the cash value earns interest and grows

The big difference is in the flexibility and lack of guarantees in universal life.

In whole life, you have to pay your premiums on time every month or year, and you can’t miss or your policy will “borrow” the premiums against the cash value, which you pay INTEREST on. In the case of universal life, the premiums are flexible and can be paid as the policyholder desires. As long as cash value is there to support the policy, it stays in good standing.

Learn more about UL vs whole life here: Universal Life Insurance: Insider’s Guide to Benefits, Pros & Cons

Dave Ramsey and Suze Orman prefer term vs universal life also! In their eyes, UL is just whole life’s evil sister.

Learn More About Term Policies Versus Permanent Insurance

If you’re comparing term vs whole life insurance, you’ll want to talk to an independent agent like myself. The “Dave Ramsey life insurance view” may or may not be right for you.

We can access and research dozens of life insurance companies so you are assured we will find the best policy at the most affordable rates. If you have health concerns, don’t let that dissuade you. We can give you valuable advice and help you to find a policy that suits you.

Enter your ZIP code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.