Term Life Insurance for 30 to 39 Year Olds

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

UPDATED: Dec 4, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Dec 4, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

If you’re 30 to 39 years old and thinking about buying term life insurance, you’ve come to the right place!

Take it from me…

I have a wife and 3 kids, and purchased two life insurance policies in my thirties, one at 33 and one at 38!

In this guide, we’ll provide sample quotes, honest advice about how much you need & awesome savings tips that will literally save you thousands of dollars.

Let’s dive in.

Table of Contents:

Inexpensive Term Policies for Those Aged 30 – 39

Term policies are the most basic and inexpensive type of life insurance available and represent our chosen offering for most clients.

The good news is that if you happen to be in your 30’s, they are exceptionally affordable.

With each passing year insurance companies see you as getting closer to your date of mortality, resulting in more expensive premiums as you age.

…not to mention the simple fact that as you get older, it’s very likely you will start to develop health issues which could make buying a policy even more costly.

Save Money When You Buy Life Insurance

Don’t wait until you get into your 40’s to buy your life insurance, because it will cost you a lot more money in the long run.

In order to illustrate just how much you can, save I ran a quote for a 31 year old non-smoking male living in California in good health (Preferred Rate). The gentleman was looking for $500,000 in coverage for a 30 year term.

At 31 he could qualify for a policy that would charge him a premium of approximately $43.00 per month.

Had the same man waited until he was 41 year old, the premium would go up to about $70.00 per month..and that’s if he was still in good health.

The difference over 30 years would be a staggering $9720.00. Just think about what he could have done with that money and these are just the numbers I generated today. Chances are 10 years from now he is looking at even more money.

“The older you are, the more expensive the premiums,” McGonigle says. Think about it this way: It is highly unlikely that a person would be healthier at age 40, 50 or 60 than they were at age 30.” – Bankrate, 7 Reasons to Buy Life Insurance Now

The bottom line is, if you need life insurance, don’t delay buying it any longer. You will save a lot of cash and your family will have the financial security they need. To top it all off, you can get life insurance ALL ONLINE!

That’s right, thanks to technology, you don’t even have to have an exam to get affordable life insurance anymore, get quotes and an answer all in a matter of minutes, it can’t hurt to check out your rates now!

Enter your ZIP code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

How Affordable is Term Insurance for a 30 – 39 Year Old?

You may be asking yourself right now, how much is life insurance for a 30 year old?

The ‘proof is in the pudding’ as they say, so I included a chart of sample quotes for non-smoking males ages 30 – 39 looking for a 30 year term for you to check out, so you can see just how inexpensive these policies really are for your age group.

These are preferred rates which means they don’t even represent the lowest possible premiums. If you are in the top 5% healthwise you may qualify for Preferred Plus rates which translate into further savings!

Please note the cost for females will be slightly lower, as women are typically less expensive to insure.

Your 30’s Are a Great Time to Buy Life Insurance!

Sample Term Life Insurance Quotes at 30-39 Years Old

| Age | $100,000 | $250,000 | $500,000 | $1 Million |

|---|---|---|---|---|

| 30 Year Old Male | $14.35 | $24.64 | $43.15 | $79.64 |

| 31 Year Old Male | $23.55 | $23.55 | $43.31 | $79.64 |

| 32 Year Old Male | $14.96 | $23.76 | $43.31 | $80.72 |

| 33 Year Old Male | $15.22 | $23.76 | $43.75 | $81.37 |

| 34 Year Old Male | $15.57 | $24.18 | $44.19 | $82.25 |

| 35 Year Old Male | $15.84 | $25.01 | $45.94 | $84.92 |

| 36 Year Old Male | $16.72 | $26.26 | $48.56 | $89.73 |

| 37 Year Old Male | $17.69 | $27.93 | $52.06 | $97.31 |

| 38 Year Old Male | $18.83 | $29.80 | $56.37 | 105.74 |

| 39 Year Old Male | $19.86 | $32.30 | $61.69 | $115.38 |

*Updated for 2020 – Monthly rates based on a male, in “preferred” health, non smoker for 30 year guaranteed level term. Rates change often and differ based on your personal health, family health history, & state of residence. Click here for correct rates based on your situation.

Keep in mind that rates constantly change and vary a lot based on your health, so it is best to get a customized quote for an accurate rate.

Being the Breadwinner is a Big Responsibility!

Nobody plans to die or become ill, but it happens to everyone at some point in their life.

There are no guarantees. But, after you’re gone, it’s the survivors who have to pick up the pieces and get on with things.

Life’s not cheap!

It’s imperative to have a financial cushion in place, that preferably lasts until you retire and a term life insurance policy is the ideal solution.

It’s the most affordable life insurance available and you can choose a term that is ideal for your individual circumstances.

RELATED: 5 Critical Tips You Must Know Before Buying Life Insurance

When Your Family Relies on Your Income You Have Responsibilities

The biggest reason most people in your age group opt to buy term insurance is for income replacement. If you’re the primary breadwinner in your family, then you have to think about what’s going to happen to your family if they no longer have your income to rely on.

We ask all of our clients to sit down and take a cold, hard look at what their income needs would be for their family should they pass away. This is incredibly important when determining the amount of coverage needed for your policy.

How Much Coverage Do You Need?

In terms of how much life insurance you need, there are varying schools of thought. Some financial advisers say you should insure five to seven times your salary, while others will say you need more. Wixon believes a good rule of thumb is three times your income plus debt. US News, When Should You Purchase Life Insurance

Sample Life Insurance Needs for a Male Non-Smoker Age 32

Using the calculator above I ran a quick quote for the life insurance needs of a 32 year old non-smoking male in California who is in good health (preferred rate) and is looking for 30 years of coverage.

He is doing well in his career and currently making $120,000 (gross) per year. Assuming 3% rate of inflation and an interest rate of 6% he would require $2,448,192 in insurance to provide an annual indexed income of $120,000! It’s hard to believe just how quickly it all adds up.

If You Prefer to Run the Numbers Yourself

Let’s say your wife needs $40,000 of income per year upon your passing. There is a simple calculation you can use to see what your needs will be: $40,000/.04 = $1,000,000 of life insurance.

To get a ballpark figure, you divide the amount per year you want your spouse or beneficiary to have, by .04, which is a good, achievable target interest rate. Therefore the nest egg you provide (1 million in the example above) earning 4% per year will generate $40,000 of income, not including taxes.

The question is, do you need to provide lifetime income to your spouse? See our “what term length is right for me?” section below.

A Few Other Considerations

- Consider the Reduced Cost of Living if You’re Not Around – What percentage of your income would your spouse or beneficiary need to continue paying the bills? It might not be 100%. For example, say you’re a 35 year old man and you make $60,000 per year, but upon your passing, your spouse is able to get by with just $30,000 per year of help. In that case, base your needs off of $30K per year target instead of $60K.

- Interest and Inflation – Any death benefit received by your family will likely be invested – so it will earn interest but inflation will also be a factor.

- Is your spouse or beneficiary able to work? Perhaps your beneficiary doesn’t currently work, but could if need be. In that case, perhaps you would need less coverage.

- Your spouse’s health and life expectancy – This is especially important for women married to older men. You might only be 37 years old but are married to a man in his 40’s or 50’s with health issues. If that’s the case, think in logical terms about his life expectancy. Does he really need 80% of your income to be replaced for 30 years if you pass away? Will he live that long? I know it’s a bit morbid, but life expectancy is a key factor to consider.

If Your Beneficiary Receives Death Benefits Were Your Premiums a Good Investment?

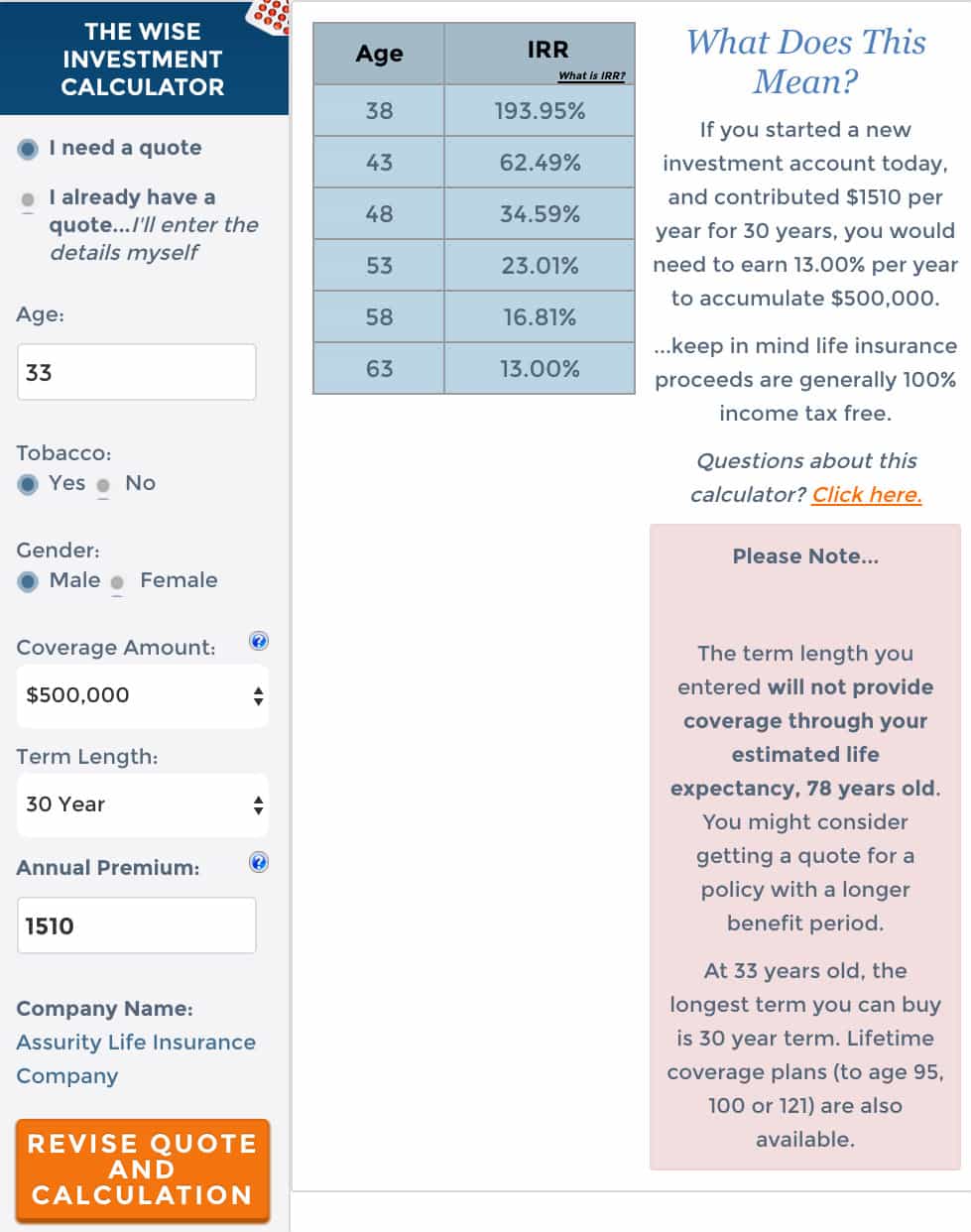

We don’t typically view life insurance as an investment. That’s why we promote term insurance over whole life, because we believe for most people there are better ways to invest money. That being said, we urge our clients to consider their IRR (or internal rate of return) should their insurance policy pay out.

For example, if a 33 year old non-smoking male, who purchased $500,000 in coverage for a term for 30 years were to die at 38 years old, his beneficiary(s) would receive death benefits that would effectively pay out as if he invested that money and received a 193.95% return.

If he were to pass away at 63, he would have had to invest money spent on premiums at 13% interest to match the death benefits.

Enter your ZIP code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

Why Buy Life Insurance Now?

Quite simply, you’ll never be 30 again or as young and healthy as you are today.

Rates increase about 5% per year in your 30’s for every year that passes.

So by waiting, not only will you see the standard rate increase for getting older, but you’ll also risk contracting a medical condition that will potentially exclude you from the best health classes.

Now that would be terrible because it would translate into a ton of lost cash.

Health and Age DO Matter!

To give you some numbers to work with I am going to provide two examples that clearly illustrate just how much health and age impact your premiums.

Preferred Rating – 34 Year Old Male vs 47 Year Old Male

A 34 year old non-smoking male, who qualifies for a preferred rating would get the following quote today:

- $44.00 per month (approx.) for 500K in coverage over a 30 year term.

A 47 year old non-smoking male, who qualifies for the same rating would get the following quote today:

- $73.00 per month (approx.) for 500K in coverage for a 20 year term.

THE DIFFERENCE: The 47 year old would pay $1680.00 more for 10 years less coverage!

Deteriorating Health – 35 Year Old Male vs 45 Year Old Male

A 35 year old non-smoking male who qualifies for a preferred plus rating would get the following quote today:

- $70.00 per month (approx.) for $1 Million in coverage over a 30 year term.

A 45 year old non-smoking male who qualifies for a standard would get the following quote today:

- $182.00 per month (approx.) for $1 Million in coverage for a 20 year term.

THE DIFFERENCE: The 45 would pay a whopping $18,480.00 more than the 35 year old and would be covered for 10 years less to boot!

As you can see from the numbers, health and age are extraordinarily important aspects of planning for your life insurance needs.

Purchasing a term policy in your 30’s puts you in a wonderful position to get super affordable rates that will cover your loved ones during the most precarious periods.

Types of Term Policies Available for 30 – 39 Year Olds

For some, a 20 year term might be ideal while for others, a 30 year term is more suitable. You can also purchase a policy which is age specific such as age 55 or 65. Most people don’t know how many options are out there.

You can also choose from 3 types of term policies which include:

• Level Term – The premium and death benefits stay the same for the length of the term

• Decreasing Term – The death benefits decrease over the life of the term with a fixed premium (generally cheaper than a level term)

• Increasing Term – The death benefits increase at predetermined amounts and at specific times as does the premium you pay (can be ideal for someone who is on a tight budget now but sees better times ahead, or has a greater financial need down the road).

As you can see, there are many options available when selecting a term policy that’s right for your particular circumstances. Here are two case studies to give you some insight into the length of term and how this decision would affect you in relation to cost and coverage.

Case 1: 35 year old male non-smoker, preferred rating, 500K in coverage

- 20 Year Term – $29.00 per month

- 30 Year Term – $46.00 per month

In this case, it may make sense for this 35 year old to consider paying the higher premium for 30 years of coverage, because chances are he will still need life insurance after the age of 55, which is when his 20 year term coverage would cease. If he is planning to have a family it would make sense to buy an inexpensive policy now to cover all his needs later in life.

Case 2: 39 year old male non-smoker, preferred rating, 500K in coverage

- 20 Year Term – $35.00 per month = $8400 over the life of the policy

- 30 Year Term – $61.00 per month – $21,960 over the life of the policy

SAVINGS: $13,560 if he buys the 20 year term!

In this case, this 39 year old may want to consider a 20 year term. If he has invested wisely and has a family at a young age his insurance needs may wrap up by the time he is 59. It really depends on the individual, but this 20 year term could save him quite a bit of money if his needs allow for it.

Which Term Length is Right for Me?

The 3 main factors you need to consider before you purchase your life insurance are:

- When do you plan to retire? Many people line up their term length with their expected retirement age. For example, if you’re 33 years old and plan to work until you’re 65, a 30 year term would probably get you closest to the goal of providing coverage as long as you work.

- Are you building a nest egg on your own? Are you saving for retirement and paying down your debts? If so, perhaps you don’t need a long term that will cover you throughout your working career

- Affordability – shorter terms cost a lot less than the 25 or 30 year terms. I always say that something is better than nothing.

If cost is a factor and you have to choose between getting more coverage or a longer term, I would say to get a shorter term and get the coverage you need.

As I mentioned above, we do have “dial-a-term” options with one of our top companies.

… so say you’re 36 years old and want coverage for the rest of your career.

That might mean you need term coverage to age 70, because you started saving late and cannot imagine retiring at 65. The problem is even if you buy a 30 year term it will only take you to age 66! This is an instance where you may want to dial up a term guarantee to age 70 instead of buying 30 year term.

We don’t have that quoting option on the right, but if you get a quote for 30 year term, the price will be similar. Call us for an accurate quote at 888-603-2876. There are all sorts of term lengths, 10, 15, 20, 25, and 30 year terms. You can even select a term that ends at a specific age such as 70 years old.

Life Insurance Savings Tips from the Pros

As an agent for 10+ years, I’ve learned some insider savings tips. Here are a couple of my best ones:

- Ladder Your Term Maturities – you can save 10-20% by buying 2 policies instead of 1. You can buy a shorter term and a longer term. As your need for insurance decreases as you get older, your first policy will drop off, and you’ll be left with a smaller amount for the remainder of your 2nd policy’s life.

- Request an Annuity Payout – we’re all familiar with life insurance companies paying out big lump sums upon the passing of the insured. But did you know you can save 10-30% by asking the insurance company to pay out the benefit over a set period of years? For example, instead of a $1 million dollar lump sum, your beneficiary might get $50,000 per year for 20 years. So they still get the million, but since the company doesn’t have to come up with it up front, they give you substantial savings on your premiums.

Tough Medical Issues? We Can Save You Up to 73% on Term Life Insurance!

Do you have a pre-existing health problem or a disability? Not to worry, we can help you. One of the biggest insurance myths is that you cannot find affordable insurance if you have a medical condition.

Insurance companies rate people differently, so I know which ones are more lenient. Health issues vary considerably so the best approach, if you’re not sure what to do, is to give me a call so we can discuss your options.

I feel confident that we will be able to find you the most affordable quote for your unique circumstances.

- No Speaking with an Agent

- Medical exam is required

- Approval may take 4-6 weeks

- Apply for same policies you would through an agent at the best prices!

Enter your ZIP code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.