A Comprehensive Kansas City Life Insurance Review

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

UPDATED: Dec 4, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Dec 4, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

What’s New in 2021 for Kansas City Life Insurance

How Has Covid-19 Affected Kansas City Life Insurance

Kansas City Life Insurance turned 125 during the Covid-19 pandemic, making it the second pandemic the company has witnessed after the Spanish Flu.

Covid-19 negatively impacted the company’s financial results during the year 2020. This was primarily due to volatile market conditions as well as increased policyholder benefits.

Enter your ZIP code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

New Products Or Changes

With the onset of the pandemic last year, Kansas City Life had suspended policy terminations due to lack of payment of premiums until June 15, 2020.

Kansas City Life Insurance in the News

Kansa City Life was in the news when it announced its financial results for the third quarter and the fourth quarter. The company declared a net loss of $1.2 million and $0.8 million in the two quarters respectively.

However, despite the losses, credit rating agency AM Best gave the company a Financial Standard Rating of “A,” which denotes “excellent” and Long Term Issuer Credit Rating of “A” as well.

These ratings reflect that the company’s balance sheet, operating profile, business and risk management procedures are strong and robust. The only points of concern noted by the agency are a high dividend payout ratio and oscillating income.

2021 Latest Kansas City Life Insurance Reviews

As per a review on the Better Business Bureau website, a customer believes that the Kansas City Life representatives have been dishonest about their policies. As per them, the policy they were sold and the policy they received were not the same. The reviewer came to know about this two years after the transaction.

A reviewer on Yelp also had negative things to say about their official communication and their customer service. On writing to Kansas City Life, the reviewer got an email that looked like spam. It had no message or contact information but a form as an attachment. On tracking the sender and contacting them, the company representative did not provide any useful explanation or help.

A recent google review appreciates the company for putting the customers first and doing good work for the community. They are particularly impressed by the work company does for charities. The reviewer also likes that a real person answers the call every time instead of an automated response.

The company has also received a few positive reviews on Facebook lately. A couple of reviewers have praised the company for good customer service, cost-effective products, and excellent quality.

Chances are that the reason you are here is that you are considering Kansas City Life Insurance.

This is great because we know all about KC Life and you are in the right place!

Whether you are you looking to provide a safety net for your family or are just planning for the what-if, KC Life Insurance may be a good choice.

Before you decide if they are the insurer for you, it’s important to find out as much information as you can about competing life insurance companies!

This comprehensive Kanas City Life Insurance Reviews guide will provide you with everything you need to know before you move forward.

From strengths to weaknesses, we’ll share insider information to help you decide if KC Life Insurance is right for your family’s needs.

Quick Guide / Table of Contents:

- Who Is Kansas City Life Insurance?

- Services Provided

- Kansas City Life Insurance Ratings – Financial

- KC Life Insurance Products

- Kansas City Life Insurance Co Underwriting Comparison

- Price Comparisons

- Bottom Line

Enter your ZIP code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

Who Is Kansas City Life Insurance?

Kansas City Life Insurance originated Kansas City, MO and was chartered as Bankers Life Association on May 1, 1895.

The company was first founded by 3 individuals including Major William Warner (President), Mr. J. H. North (Vice President) and Mr. S.E. Rumble (Secretary).

The company changed its name to Kansas City Life Insurance Company in 1900 and it was then that the company began issuing small life insurance policies. In 1924, the company moved to its current location.

Is Life Insurance for You?

Kansas City Life insurance, a public company with over 500,000 policyholders from coast to coast, operates in 48 states and the District of Columbia. Its agency has more than 2,500 representatives and a staff of over 400 who provide support to both field agents and policyholders.

Kansas City Life Group was chartered on May 1, 1985, as Bankers Life Association and Kansas City Life Group which includes the following companies:

- KC Life Insurance Company

- Old American Insurance Company

- Sunset Life Insurance Company of America, and

- Sunset Financial Services, Inc. (A wholly owned subsidiary of KC Life Insurance Company)

RELATED: 5 Critical Tips You Must Know Before Buying Life Insurance

Services Provided

Kansas City Life Insurance Company provides the following services:

- Individual Life Insurance Products

- Annuity and Group Products Through General Agencies

- Variable Life Insurance and Variable Annuity Options

- Mutual Funds via Sunset Financial Services Inc.

This group also offers a variety of insurance types such as life insurance, dental insurance, and vision insurance and specializes in group term life and voluntary life.

Kansas City Life Insurance Ratings – Financial

Any person who is thinking about buying life insurance needs to confirm the company they buy their policy from is financially sound.

In other words, you have to be comfortable that the insurer will be able to honor any claims your family may make.

A solid rating means that the company has sufficient cash reserves to pay out its policyholders.

In conclusion, financial ratings are given by companies which specialize in analyzing the stability of life insurers for your protection.

Kansas City Life Insurance Co is very secure financially and holds a respectable ranking.

According to A.M. Best, as of July 2016, the financial rating for Kansas City Life Insurance Company was: –A (Excellent)

There are a total of 13 ratings in use by A.M Best ranging from A++ (Superior) to D (Poor).

A.M. Best states the company’s overall performance is excellent and its future outlook is thought to be stable over the long term.

In summary, Kansas City Life Insurance Reviews is an excellent choice and policyholders can rest easy that the future financial prospects of this company are strong.

Enter your ZIP code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

KC Life Insurance Products

Kansas City Life Insurance Co sells quite a variety of products, which includes a nice mix of both Term and Permanent life insurance offerings and riders.

Policies which you can choose through Kansas City Life include:

- Term life

- Universal Life

- Indexed Universal Life

- Variable Universal Life

- Whole Life Insurance

- Annuities

- Return of Premium Rider

Kansas City Term Life Insurance

What I like about Kansas City Life is that they have a number of choices for term policies which include:

- Choice Term 20: The minimum policy amount is $250,000 and the minimum purchase age is 18. Premiums do not change.

- Level Term Insurance: For terms of 10, 15, 20 and 30 years.

- Level Advantage Term: For terms of 10, 15, 20 and 30 years.

*All term plans come with a conversion option.

An insurance policy in which the insurer is required to renew or update the policy regardless of the insured’s health. An insurance policy with this type of provision allows the insured to switch to a different type of policy without submitting to a physical examination. Investopedia, Conversion Privilege

KC Universal Life Insurance

Universal life is more flexible than Whole life because you have more options to manage your policy.

Kansas City Universal life provides greater control over premiums and offers adjustable coverage. This enables you to adjust your death benefits and increase or decrease your premiums.

You can also change the frequency of your payments or even stop them altogether for a period of time. Interest rates are also guaranteed to never fall below the rate specified in your policy.

RELATED: Check Sample Life Insurance Rates by Age (No Personal Info Required)

You can also direct your premiums into an indexed account based on the S&P 500 for a 1 year period. You have 2 choices of index accounts and each has a different limit.

Sunset Financial Services Inc provides a variable life insurance product series that is generally available through prospectus only.

Kansas City Whole Life Insurance

Whole life is a much more conservative form of permanent life insurance. This policy is generally popular for those who are averse to risk.

Premiums are guaranteed for the life of the policy. Death benefits are also guaranteed, but you have no options in regard to changing your premiums or the amount of death benefits.

You simply select the amount of coverage and pay the assessed premium according to schedule.

We at Huntley Wealth strongly advocate that whole life insurance only works for a very small percentage of the population. In most cases, we recommend that clients buy term and invest the rest.

Forty years ago, whole life insurance made a lot of sense as an investment vehicle. Today, it’s as outdated as disco, hula hoops and pet rocks. Tony Steuer, The Case Against Whole Life Policies

Annuities

Kansas Life Insurance offers a variety of annuities. These policies are available through Sunset Financial Services Inc.

An annuity is a long term investment that provides guaranteed income payments for life. There are 2 types of annuities you can choose which include:

- Fixed Annuity – which guarantees a fixed rate of interest and variety of payout options

- Variable Annuity – allows you to choose from a variety of investment and payout options

You can also select beneficiary options so you can determine who will receive funds upon your death.

Return of Premium Rider

A Return of Premium (“ROP“) Rider is available for Term life insurance policies only. ROP options through Life Insurance Kansas City are available for 20 and 30-year terms.

Both provide a full return of premium benefits upon expiry. You can also opt for a non-forfeiture provision which allows you to continue your life insurance coverage without further cash outlay.

Additional Life Insurance Riders

There are other types of life insurance riders available including:

- Income Insured Option

- Terminal Illness Rider

- Waiver of Premium

- Accidental Death Benefit

- Spouse’s or Children’s Rider

Wow! This company really does provide an impressive array of life insurance products.

Kansas City Life Insurance Co Underwriting Comparison

I am going to compare Kansas Life Insurance underwriting guidelines to 2 other random companies. Every life insurer rates individuals differently and some are more lenient than others.

The 2 other companies which we chose include American General Life Insurance and Metlife Insurance.

We are going to look at their guidelines for a “Preferred Plus” Term life policy for a male who is at 5’ 10 “tall. Our rating features will examine the following 5 factors:

- Weight and Build

- Smoking

- Blood Pressure

- Cholesterol Levels

- Family History

Here are the underwriting health guidelines:

KC Life Insurance

Height Weight Build

- A 5’ 10” male cannot weigh more than 192 Pounds

Tobacco Use

- No tobacco for 5 Years.

Maximum Blood Pressure

- No medication

- Age 0-50: Blood pressure no higher than 135/85

- Age 51 Plus: Blood Pressure no higher than 140/90

Maximum Cholesterol Treated

- Cholesterol level maximum: 220 (allows for use of cholesterol-lowering medications)

- Cholesterol/HDL Ratio – Must be < = 5.0

Family History

- No cardiovascular disease, insulin-dependent diabetes, or cancer prior to age 60 in parents or siblings or any other hereditary disease.

American General Life Insurance

Height / Weight Ratio

- A male who is 5’ 10 “tall can weigh between 130 – 205 pounds.

Tobacco Use

- No tobacco use for 5 years

Blood Pressure

- From ages 0 – 60: Blood pressure not greater than 135/85

- From ages 61 Plus: Blood pressure not greater than 140/85

Cholesterol HDL Ratio

- If ratio Less than 5, 215 cholesterol level

- If ratio less than 4.5, 290 cholesterol level

Family History

- There must be no coronary artery disease or cancer prior to age 60 (Parents only)

Met Life Insurance (Elite Plus)

Height Weight Build

- A 5’ 10” Male and no heavier than 188 pounds

Tobacco Use

- No nicotine use for the past 60 months and negative nicotine test.

Blood Pressure

- Ages 40 and Under: 130/80

- Ages 41 – 54: 135/85

- Ages 55 – 69: 140/85

- Ages 70 and Over: 140/90

Cholesterol HDL Ratio

- Ages 54 and Under: 220/4.5

- Ages 55 – 69: 230/4.5

- Ages 70 and Over – 140/90

Family History

- No cardiovascular disease or cancer (some cancers may qualify) in either parent or siblings before age 60.

Summary Of Kansas City Life Insurance Reviews Underwriting

After analyzing the underwriting guidelines above I have determined that life insurance Kansas City is very lenient in some areas while more conservative in others.

As I mentioned, underwriting requirements vary significantly from company to company.

As a result, you should always consult an independent life insurance agent, such as Huntley Wealth. We can help you go through all the different guidelines to find the best possible policy for your particular circumstances.

How Does KC Life Insurance Compare Price-Wise?

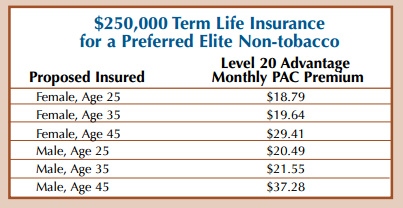

The next step is to compare rates. I used Term4Sale.com to generate figures for a 20 Year Term policy for male and female non-smokers with a “Preferred Plus” rating with $250,000 coverage.

Here is a quick snapshot of the premiums you might expect to pay at Life Insurance Kansas City, American General & MetLife:

Kansas City Life Term Insurance Quotes

American General Term Life Insurance Quotes

25 Year Old Female: $11.81 monthly

35 Year Old Female: $13.54 monthly

45 Year Old Female: $25.21 monthly

25 Year Old Male: $13.22 monthly

35 Year Old Male: $14.62 monthly

45 Year Old Male: $31.27 monthly

Met Life Insurance Quotes

35 Year Old Female: $13.64 monthly

45 Year Old Female: $26.01 monthly

25 Year Old Male: $14.09 monthly

35 Year Old Male: $15.44 monthly

45 Year Old Male: $32.09

Kansas City Life Insurance Premium Analysis

Whoops! It looks like Kansas City Life Insurance premiums are a bit pricier compared to other life insurers.

I don’t want to mislead you, their premiums are competitive and definitely cheaper than many other life insurers, but they are bit higher than the top 10 most affordable companies.

The Bottom Line

Based on the availability of products, underwriting criteria and premium costs, Kansas City life insurance Co in an excellent life insurer.

Not only does it have an excellent range of life insurance products and riders, but their underwriting guidelines are relatively competitive for a variety of health issues.

Unfortunately, their premiums are slightly more expensive, but they are in no way overpriced.

In conclusion, you may be able to find more affordable premiums if you work with an independent agent such as Huntley Wealth, but overall Kansas City Life Insurance review is a solid company.

Contact Us At Huntley Wealth

Let us help you sift through all the options available to you.

If you are looking for low-cost term or permanent insurance call the independent agents here at Huntley Wealth today! We have access to dozens of life insurers and will work diligently to get you the best deal for your circumstances.

We don’t work for the insurance companies, so our agents will only promote the best possible product.

Do you have a pre-existing medical condition? If so, we can help!

Huntley Wealth specializes in high-risk life insurance. From bad hearts to missing parts, we’ve got you covered.

Call Huntley Wealth right now at 888-603-2876. We can help!

Enter your ZIP code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.