Expiring Term Life Insurance Policy? Here’s How To Save It!

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

UPDATED: Mar 23, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Mar 23, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

If you have a 10, 20 or 30 year level term life insurance policy nearing expiration, listen carefully.

… We could help you save your policy!

I know you have a lot of questions about your policy like:

- What happens when the term expires?

- Will I lose my life insurance coverage?

First, take comfort in knowing your policy may not be “expiring” at all.

… but even if it is, there are actually several options for saving or extending your policy.

In this article, we’ll teach you how term life insurance works, what happens at the end of the “level benefit period,” and reveal 5 actions you can take if you have an expiring policy.

With all the options we will show you below, I can honestly say that the most cost effective option 98% of the time will be to just get a new policy.

However, there are some instances where that option isn’t available.

Quick Navigation Guide

Use our guide below to navigate through your options quickly.

- First: Your Policy Probably Isn’t “Expiring”

- Why Premiums Increases After the Initial Term Period

- 5 Actions to Take When Your Term is about to Expire

- Companies Who Offer Reasonable Renewal Premiums

First things first, let’s clear the air on whether not your life insurance policy is actually ending, because, well… it’s not.

The Myth That Term Life Insurance “Expires”

Most term life insurance policies actually cover you to age 95.

That’s right:

At the end of your initial term, most term policies do not expire.

So it’s a misnomer to say your policy is “expiring.”

What’s actually happening is your initial level term period is ending.

What’s this mean?

It means your policy may not be ending at all, but the premiums will most likely be increasing every year moving forward on an annual basis, in most cases, to an astronomical amount.

Read more: How does the insurance company determine my premium?

Now, don’t get me wrong:

There is a such thing as renewable term life insurance.

However, almost all policies are renewable, and if you are unsure, you can just ask the insurance carrier or agent directly.

Renewable term life insurance simply confirms the term life insurance policy you have is able to be renewed without you having to go back through medical underwriting.

It’s really a great option if you end up being in worse health over time.

The problem is, there are only a couple of carriers, such as Lincoln, whose renewal premiums are not outrageous and Protective Life Insurance.

You’ll need to wait for your renewal of premium notice to arrive to find out what the adjusted premium will be.

Pro Tip: If you’re in the market for a new policy, be sure to consider one with Low Renewal Premiums!

[instantquote]

Understanding Term Life Insurance & Premium Increases

Let’s say at age 40; you buy an annually renewable policy.

For insurance purposes, every year you live makes you a bit more of an insurance risk.

… So your premiums rise annually as you are one year closer to death.

Such policies are available, but they’re not very popular since the premiums go up every year.

They’re called annual renewable term (ART).

Let’s look at sample ART premiums for $1,000,000 in coverage for a male non-smoker.

ART premiums might look like this for the first few years:

- 1st year might be $250

- $265 in the 2nd year

- $275 in the 3rd year

- etc.

10 years later, your premium may actually rise to $450 per month for coverage! This example illustrates why people tend to shy away from this type of policy.

Most people would instead plan their budget around a fixed expense.

The result is, many insurance carriers offer level term life insurance policies.

In essence, they’ll cover you until age 95, but for 10, 15, 20, or 30 years the premium is fixed.

Calculating Level Term Premium – It’s a Simple Average

To determine your level premium, life insurance companies add up the payments for each year in the 10 year term and divide it by 10.

Mostly, 10 year level term life insurance is the average premium for the first 10 years of coverage.

From year 11 up, or in the case above, from ages 50 – 95, it reverts to an annual renewable policy. (For more information, read our “Annual Renewable Term Life Insurance“).

It’s essential to lock in for as long of a level term as you think you might need for coverage. In a nutshell, once the level term is up, your premiums will skyrocket.

Enter your ZIP code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

5 Actions to Save Your “Expiring” Policy (PLUS 2 BONUS OPTIONS)

Most policies offer several options when the initial term is about to expire:

- Replace the Policy with a Cheaper One – If you’re still healthy enough to qualify for a new term policy, consider doing so. It’s likely the new policy will cost a fraction of the renewal premium payment. Click here for a replacement quote.

- Convert the Policy – Check the policy’s conversion features. You may be able to convert the policy to a permanent policy without evidence of good health. If your health has deteriorated since the term policy was issued, this may be a good option for you. See notes on term policy conversion here.

- Pay the Renewal Premium – If you can’t afford to convert your policy or replace it, then you might consider paying the renewal premium. You’ll have to take your health and estimated life expectancy into account, as well as how long you will need coverage. If you’re healthy and need it for several years, it’s probably best to buy a new policy.

- Decrease Your Death Benefit – Many companies allow a one-time decrease in face value to your policy. The result? A reduction in your premiums.

- Sell Your Policy – If your policy is still convertible, you may be able to convert the policy and then sell it. It’s called a life settlement. If your health has deteriorated, this could be a particularly lucrative option for you.

BONUS OPTION #1

Let’s say you decide to reduce your death benefit or pay your renewal premiums.

… there might STILL be a way for you to save some money.

Has your health improved since you first bought your policy?

Perhaps you lost a lot of weight or stopped smoking, for example.

If that’s the case, most carriers allow a one-time application for a “health re-classification,” in which they essentially reclassify you based on your current health and lead to an immediate reduction in your premium.

BONUS OPTION #2

Option 6 – Let Your Policy Lapse – If none of the 5 options above work for you, or you can’t afford your policy or no longer need it, just stop paying premiums and the policy will lapse.

The insurance company can’t “come after you” to pay. You’re not “obligated” to pay for the duration of the full term length.

It’s simple.

If you stop paying your premiums, all that happens is your policy will lapse, and you’ll no longer have coverage.

Looking to Replace Your Coverage? Try These Companies!

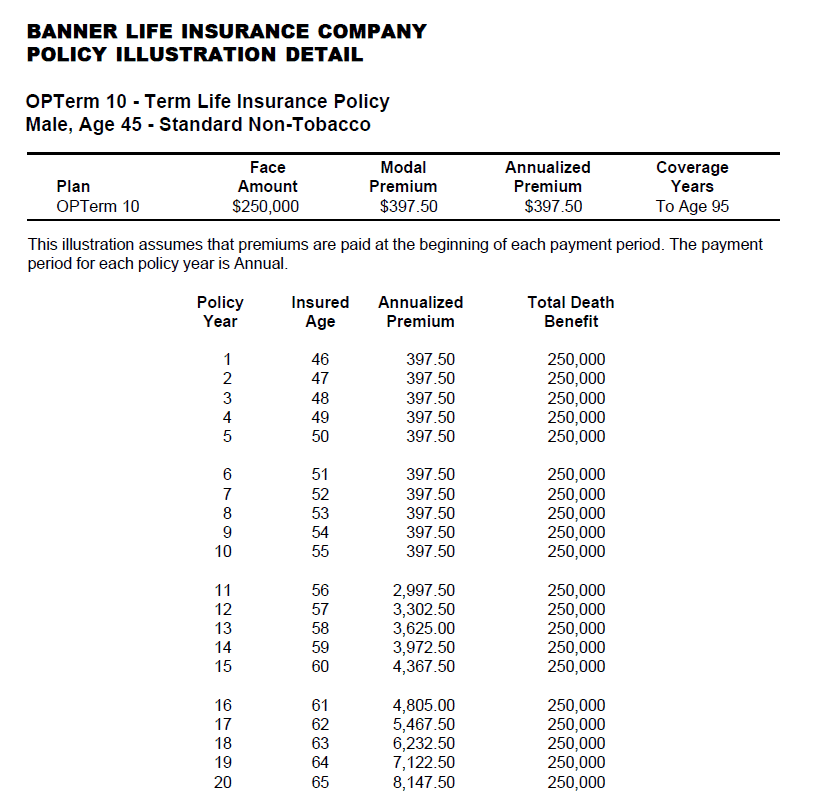

In most cases, the increase from the level term premium to the renewable premium is outrageous.

Since most policyholders originally bought an affordable term life insurance policy, you can bet they’ll be in for a surprise when they open up their renewal letter.

Premiums have been known to increase by 6-10 times the cost of the initial payments!

Below is an illustration of guaranteed premiums on a term policy:

Luckily, I’ve found a few surprising exceptions to the rule!

These policies are offered by Lincoln Financial Group (LifeElements), Protective Life Insurance, and Fidelity Life Association (Graded Death Benefit).

*Please note these comments are valid at the time of writing this article and are subject to change.

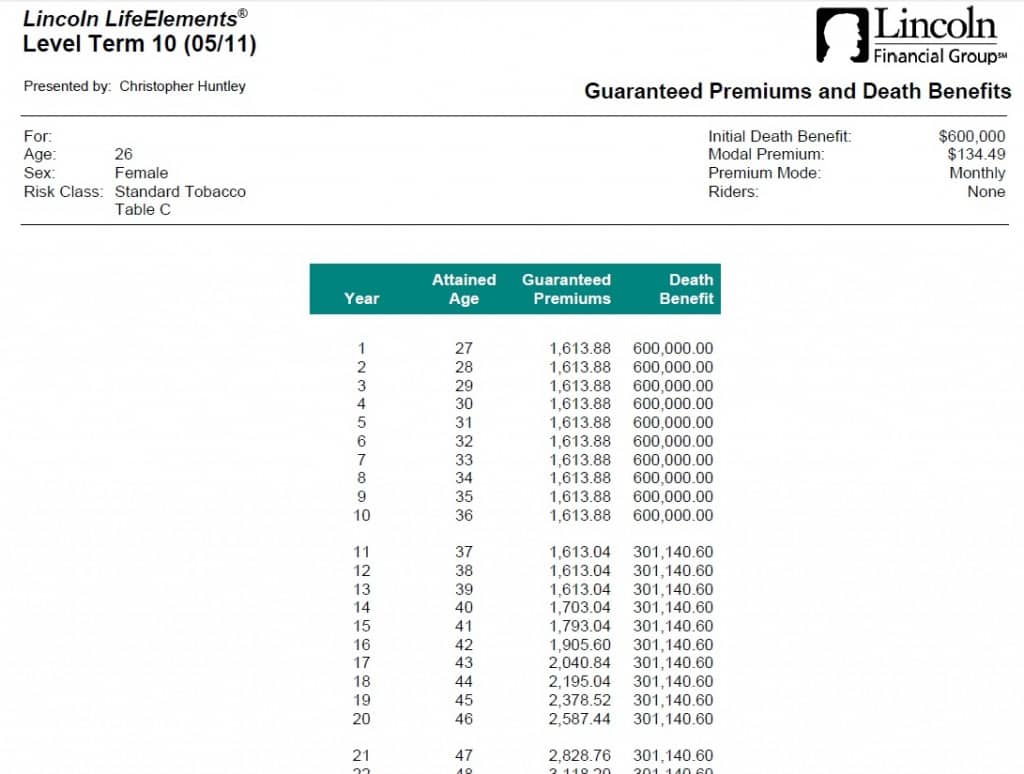

Lincoln Financial Group

Instead of raising the premium, at the end of your term Lincoln lowers the death benefit to approximately half the initial value.

Your payments are guaranteed to stay the same for at least a few years after expiry of the initial term.

Then the guaranteed premiums marginally increase, by approximately 5% per year, for the next several years.

Below is a sample illustration of the Lincoln LifeElements guaranteed premiums of a 10 year term policy:

Fidelity Life Association

Fidelity Life Association offers a type of graded death benefit life insurance.

The best part?

The premiums are guaranteed to stay level for the life of the policy.

- 10 year term: until age 80 or for 20 additional years, whichever is longer ;

- 20 year term/30 year term: until age 80 or for 25/35 additional years, whichever is longer.

Like Lincoln, Fidelity also decreases the death benefits in the following manner:

- At year 11, 21 or 31 whichever is applicable, there is a one-time decrease in the face amount based on the original issue age;

- 20-29 years old to 80% of the original face amount;

- 30-39 years old to 70% of the original face amount;

- 40-49 years old to 60% of the original face amount;

- 50 years old and up 50% of the original face amount

Read more: What is decreasing term life insurance?

Renewal Companies Conclusion

Both companies offer affordable premiums after the initial term expires.

In this case, you can actually afford to potentially keep your policy, as opposed to having to drop it.

More on Lincoln Pricing

Lincoln’s term policies aren’t the most affordable among the low price leaders in term coverage, such as Banner, SBLI, or Transamerica.

The premiums quoted are typically 10 – 20% higher, but they have a superior renewal benefit; which makes the increase in price a bit more palatable.

Let’s say you’re shopping for a 10 year term, but you might need insurance for up to 15 years. (For more information, read our “What is a 10-year term life insurance policy?“).

You don’t want to pay for 15 year term up front because you probably won’t need it that long.

Buy the 10 year term from Lincoln, and your problem is solved. Don’t forget, coverage is reduced in year 11!

Read more:

More on Fidelity Pricing

Fidelity is unique, as their product is designed for people with serious medical issues.

Someone with a history of cancer, stroke, epilepsy, alcohol/drug abuse, or extreme obesity may still be able to qualify for their graded death benefit.

To give you an extreme example, a man who is 5’11 could weigh up to 428 lbs and still be approved.

That same individual could also have had a heart transplant and lung cancer three years ago and assuming no treatment was necessary for the past 2 years, may still qualify!

Contact Us Today!

There are many options available when your level term policy is nearing expiry.

Be sure to speak with a knowledgeable agent about your ongoing insurance needs for the best advice for your unique circumstances.

At Huntley Wealth we have over 10 years of experience finding life insurance for people from all walks of life, and we would love to help you.

Our number is 888-603-2876. Give us a call, or you can get a quote using our quote form on the right.

Enter your ZIP code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.