Life Insurance Riders

When you purchase a life insurance policy, it will offer basic life insurance benefits.

Primarily, that means a cash value accumulation in a whole life insurance policy and a death benefit for both whole life and term life insurance. But much like adding options to a car, you can do the same with life insurance.

Only with insurance, they’re referred to as riders, not options.

There are many you can add, but in this article, we’ll discuss the most common life insurance riders.

What is a Life Insurance Rider?

A rider is a provision that can be added to a life insurance policy to provide an additional benefit that the basic policy doesn’t.

In most cases, the rider either adds a specific benefit or extends the term of the policy beyond the original one.

Are Life Insurance Riders Worth It?

Since a rider provides an additional benefit, it also adds to the cost of the premium. For that reason, you’ll always want to weigh out the cost of the rider versus the benefit it provides. Naturally, if you add several riders to a basic policy, it can raise the premium considerably.

The type and cost of life insurance riders can vary widely from one company to another, and from one policy to another. When shopping for insurance, it’s important to discuss with your agent exactly what you want your policy to do.

- Life Insurance

- Prudential’s Living Needs Rider & Long Term Care-Like Benefits

- AD&D Insurance | What Does Accidental Death Life Insurance Cover?

- What is a Waiver of Premium Rider?

- What is a Child Term Rider?

- What is a Family Income Benefit Rider?

- Return of Premium Life Insurance

- Accidental Death Benefit Rider

- What is an Accelerated Death Benefit Rider?

- What is a Term Rider?

- Life Insurance with Long Term Care

Sure, you want basic life insurance, but you may have additional needs. Inform your agent to see which riders are available that will address that concern.

The specific rider needed, as well as the cost, can be a major factor in determining exactly which life insurance company is used.

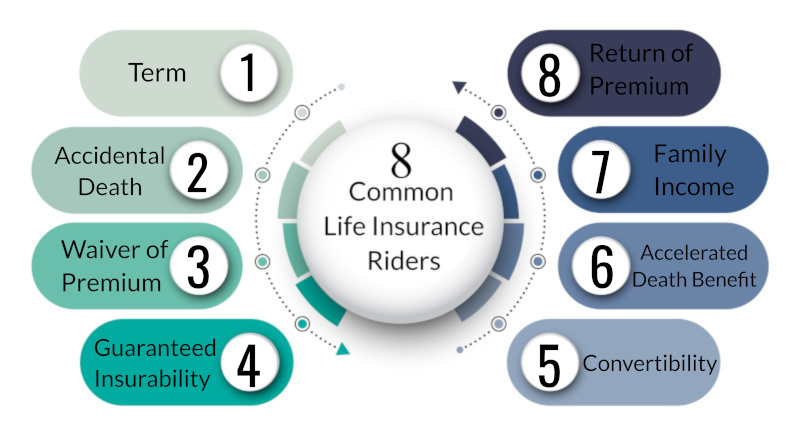

8 Most Common Life Insurance Riders

Most people know about a long-term care rider, but that’s not the only rider available.

Below is a list of eight of the most common life insurance riders:

1. Term Rider

These can be attached to a whole life insurance policy to increase the death benefit during a time of maximum need.

The primary limitation of whole life insurance is cost. Since it costs many times more than term life insurance for the same death benefit, the face amount of the policy will be limited.

It may work as a base life insurance benefit. But, if you’re going through a time when you need additional coverage and can’t afford the higher cost of a larger whole life policy, a term rider can be added to the policy.

For example, let’s say you purchase a $100,000 whole life policy that you intend to keep for the rest of your life. But, for the next 20 years, while you’re raising your children and paying your mortgage, that coverage level won’t be nearly enough.

The problem is remedied by adding a term policy on top of the whole life policy.

In this case, you might add a $400,000 20 year term rider to your whole life policy. That will give you $500,000 in total coverage until your children are adults and your mortgage is paid.

Once both events have taken place, the term rider can be allowed to expire, bringing you back to the original $100,000 death benefit of the whole life policy.

Read more: What is a Term Rider?

2. Accidental Death Rider

As the name implies, this rider provides additional death benefits if the cause of death is due to an accident.

In most policies, an accidental death rider will double the face value of the death benefit. Should you die of natural causes, a policy may pay $200,000. But, if you die from an accident, it will double to $400,000.

This will only happen if the accidental death rider is added to the policy.

This can be a valuable rider, given that accidental death is sudden and doesn’t give your family an opportunity to prepare in advance. The additional funds may help to offset the unexpected liabilities that can result from sudden death.

It can be especially important if you work in an occupation where the possibility of accidental death is higher than normal. For example, if you work in sales and travel frequently – especially by car – accidental death is a higher possibility.

One limitation to be aware of, however, is that an accidental death rider pays only in accidents specifically listed in the rider. For example, it may exclude accidental death connected with your employment, or with certain dangerous hobbies.

This is an important technicality we can help you with should you decide to add this rider to your policy.

Learn More: Accidental Death Rider

3. Waiver of Premium Rider

If you add this rider to your policy, the insurance company will waive your premiums if you become disabled and unable to work. That being the case, you may not be able to afford to pay your premiums.

The waiver will relieve you of that burden while keeping your policy in force.

However, waiver of premium typically involves a waiting period, which could be up to six months. How long it will last depends on the type of policy it is.

For term policies, the waiver will generally last through the end of the term. For whole life policies, it will generally end when you reach age 65.

In either case, you will need to meet the criteria for disability as described in the policy. That can vary from one insurance company to another.

Read more:

4. Guaranteed Insurability Rider

This rider is most valuable with term life insurance. Since all term policies expire at the end of the stated term, this rider will guarantee you’ll be able to renew the policy for another term.

What’s more, that guarantee extends to your health. Even if you develop a health condition since taking the original policy, this rider will guarantee your acceptance for a renewal.

For example, let’s say you take a 20-year term policy. During that time, you have a bout with cancer. But, when the term is about to end, the insurance company gives you the option to extend the policy for another five years.

You’ll pay a higher premium due to the fact that you’re 20 years older. Your cancer event won’t figure into the renewal since it’s guaranteed by the rider.

This rider can also be valuable in conjunction with a whole life policy. If the rider is added to your policy, it guarantees you the right to purchase additional insurance in the future, once again regardless of the condition of your health.

This can be especially important with whole life, since the cost of that type of insurance limits how much you can buy. If you’re in a better financial position in the future and you want to purchase more coverage, you’ll be able to do it with the same insurance company.

Learn More: Guaranteed Insurability Rider

5. Convertibility Rider

The convertibility rider applies specifically to term life insurance policies. It allows you to convert a term policy – which is temporary life insurance – to a whole life policy, converting it into permanent insurance.

One of the biggest advantages is that you can do so without needing to qualify for the conversion based on the condition of your health.

With this rider, you’ll be able to convert the term policy to whole life either anytime before the term expires or within a certain time frame.

While the convertibility rider ignores your health, it does consider your age. In most cases, the premium you’ll pay for the whole life conversion will be based on your age at the time you convert.

If you were 25 when you took the term policy, but 40 when you convert it, the premiums will be based on your age at 40, not 25.

This is an outstanding option to have, but it is one of the more expensive riders. It has the potential to significantly increase the cost of your term premiums.

Carefully weigh out if you’ll be more likely to convert to a whole life policy, or simply to extend the term policy by renewing for a new term.

Learn More: Life Insurance Conversions

6. Accelerated Death Benefit Riders

This can be one of the most valuable riders you can add to any life insurance policy.

In the event you develop a terminal illness, this provision can give you a cash advance against your death benefit. It’s sometimes referred to as a living benefit.

In most cases, the rider will apply if you’ve been diagnosed with a terminal illness with a life expectancy of less than one year. The funds can be used to pay for direct medical expenses, or for general living expenses.

The insurance company may place limits on what percentage of the death benefit can be paid in advance. For example, they may limit the benefit to 50% of the policy’s death benefit.

Any funds not paid out while you are alive will be payable to your beneficiaries upon your death. In that way, the rider converts your life insurance policy to a hybrid policy, providing both living benefits and a death benefit.

Learn More: Accelerated Death Benefit Rider

7. Family Income Rider

This rider affects how the death benefit of your policy will be paid to your beneficiaries. Rather than paying out the death benefit in a lump sum, it instead provides for the funds to be distributed over several years.

This is sometimes referred to as a “spendthrift provision,” since it eliminates the possibility of the entire death benefit being spent quickly after payout.

You can select the number of years the death benefit will be paid over. For example, if you have a $1 million policy, you can specify a 20-year payout, at $50,000 per year.

In most cases, the insurance company will also include an interest income provision, since the funds will not be paid out immediately.

This rider will enable you to use your life insurance policy to create a regular income for your beneficiaries. It will ensure a steady cash flow well into the future.

The provision can be especially important if you, as the insured, are also the prime money manager in the household. It will ensure there’s always money coming in on a regular basis to meet the family’s living expenses.

Learn More: Family Income Rider

8. Return of Premium Rider

This rider is specifically for term life insurance policies. Unlike whole life policies, term policies don’t come with a cash value. As a result, you can pay premiums steadily for 20 years on a 20-year term policy without ever having filed a claim. It can seem like money lost.

But, if you add a return of premium rider, the insurance company will refund those premiums at the end of the term. For example, if you paid $500 per year in premiums for 20 years, you’ll be refunded $10,000 ($500 X 20 years) when the policy expires.

Since the insurance company will be earning investment income on your paid premiums, they’ll be able to afford fully refunding what you paid in, while still earning money on the policy.

The major downside of this rider is that it’s expensive as you get older. But, if you’re young, in good health, you don’t live dangerously, and your family history is one of exceptional longevity, it’s relatively inexpensive.

It may be well worth paying the slightly higher premium to get your premiums back at the end of the term.

When the premium is refunded, it will be as if you had life insurance coverage for 20 years, but at no cost.

Learn More: Return of Premium Rider

Other Life Insurance Riders

Which Life Insurance Riders Do I Need?

Some of these riders are admittedly complicated. But, that’s why we’re here to help. As your agent, we may also be aware of other riders that provide additional benefits.

At Huntley Wealth, we’re an independent insurance agency working with many different insurance companies. We know the specific nuances and costs of each of these riders with the different companies.

That’s important because while the types of riders may be standard, the specific provisions are not. One company may have more limited events in which they’ll pay the rider benefit, and may not be suitable for what you’re looking to do. Others may have an outstanding provision, but not be cost-effective.

As your agent, tell us what you’d like your life insurance policy to do, and we’ll build in the most cost-effective riders to make it happen. We promise to get you the best life insurance policy at the most affordable premium rate.