Progressive vs. State Farm Car Insurance in 2026 (Which is Better?)

When comparing Progressive vs. State Farm car insurance, State Farm has lower rates, starting at just $33 per month. Meanwhile, Progressive offers a wider range of coverage options, like custom parts coverage or gap insurance, and unique budgeting tools like Name Your Price.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeff Root

Licensed Insurance Agent

Jeff is a well-known speaker and expert in life insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading...

Licensed Insurance Agent

UPDATED: May 23, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

13,285 reviews

13,285 reviewsCompany Facts

Min. Coverage

A.M. Best Rating

Complaint Level

13,285 reviews

13,285 reviews 18,157 reviews

18,157 reviewsCompany Facts

Min. Coverage

A.M. Best Rating

Complaint Level

18,157 reviews

18,157 reviewsWhen comparing Progressive vs. State Farm car insurance, State Farm has cheaper auto insurance rates on average for good drivers, making it the better choice for those looking into how to get cheap car insurance.

However, high-risk drivers may find it easier to get coverage at Progressive, and Progressive offers more coverage options than State Farm.

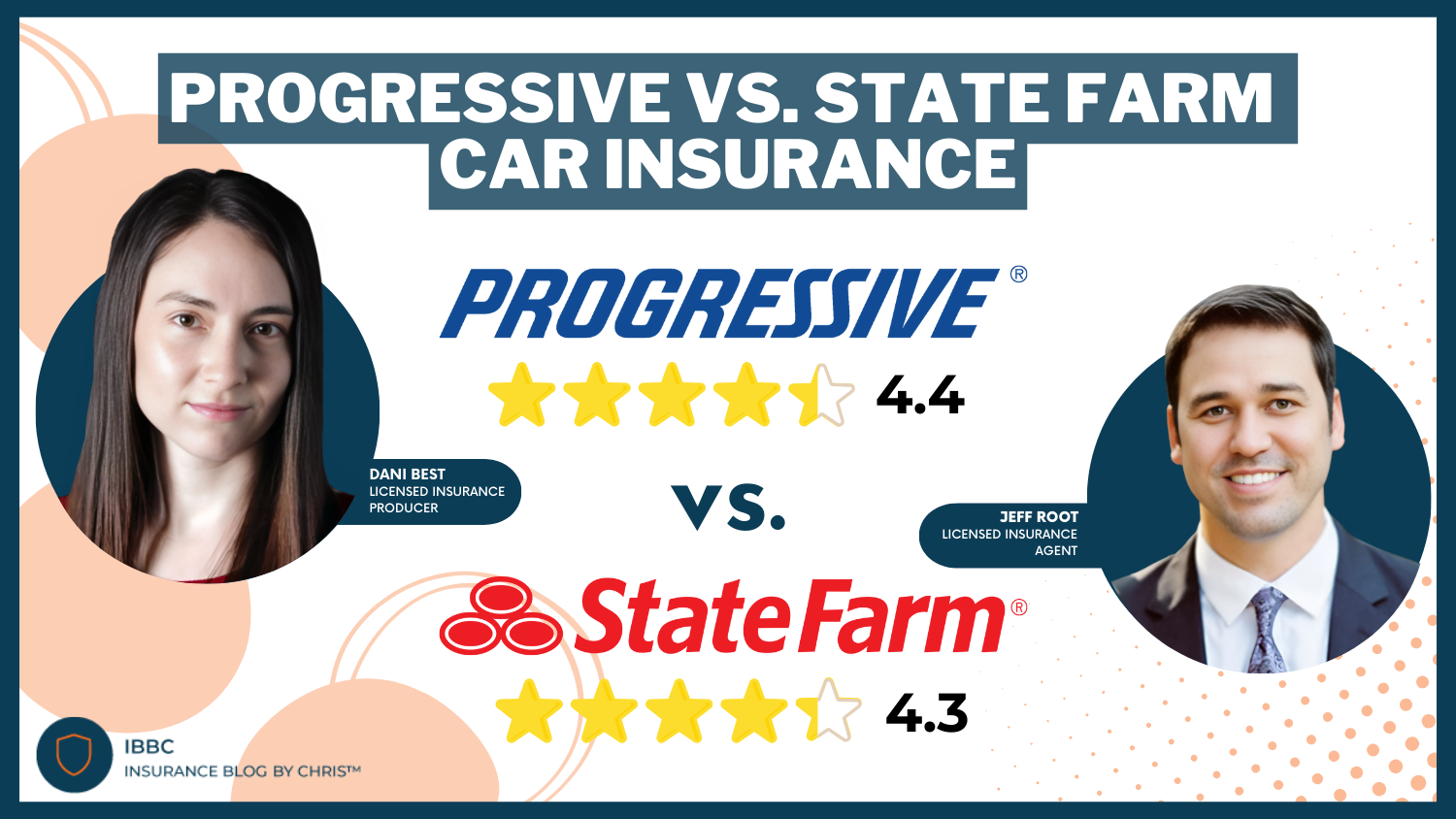

Progressive vs. State Farm Car Insurance Rating

| Rating Criteria | ||

|---|---|---|

| Overall Score | 4.4 | 4.3 |

| Business Reviews | 4.0 | 5.0 |

| Claim Processing | 3.5 | 4.3 |

| Company Reputation | 4.5 | 4.5 |

| Coverage Availability | 5.0 | 5.0 |

| Coverage Value | 4.2 | 4.2 |

| Customer Satisfaction | 4.1 | 4.1 |

| Digital Experience | 4.5 | 4.5 |

| Discounts Available | 5.0 | 5.0 |

| Insurance Cost | 4.3 | 3.9 |

| Plan Personalization | 4.5 | 4.5 |

| Policy Options | 5.0 | 3.8 |

| Savings Potential | 4.5 | 4.3 |

| Progressive Review | State Farm Review |

To make your research process easier, we’ve compared State Farm vs. Progressive over several categories, including rates, discounts, reputation, and more.

- State Farm has cheaper rates starting at $33 per month

- Progressive offers an average savings of $231 annually with Snapshot

- Both companies have A+ ratings for business practices from BBB

If you want to get car insurance quotes from local companies, enter your ZIP in our free tool. It will help you compare quotes to find the best deal on car insurance.

Progressive vs. State Farm Car Insurance Rates

Check out these average rates for State Farm vs. Progressive below to see what you could pay for full or minimum coverage:

Progressive vs. State Farm: Full Coverage Car Insurance Monthly Rates

| Age & Gender | ||

|---|---|---|

| 16-Year-Old Female | $801 | $311 |

| 16-Year-Old Male | $814 | $349 |

| 30-Year-Old Female | $131 | $94 |

| 30-Year-Old Male | $136 | $103 |

| 45-Year-Old Female | $112 | $86 |

| 45-Year-Old Male | $106 | $86 |

| 60-Year-Old Female | $92 | $76 |

| 60-Year-Old Male | $95 | $76 |

State Farm is cheaper than Progressive on average for all age groups of drivers, especially if drivers choose minimum coverage. Depending on your vehicle and imposed requirements, you can determine which level of coverage is best for you.

Read More: Free Car Insurance Calculator

When you obtain a quote from each company, compare Progressive vs. State Farm auto insurance side-by-side to see how protection levels for each coverage type compare financially.

Driving record also impacts rates at Progressive and State Farm. See the difference between Progressive vs. State Farm car insurance rates on average below.

Progressive vs. State Farm: Full Coverage Insurance Monthly Cost by Driving Record

| Driving Record | ||

|---|---|---|

| Clean Record | $106 | $86 |

| Not-At-Fault Accident | $186 | $102 |

| Speeding Ticket | $140 | $96 |

| DUI/DWI | $140 | $112 |

| Reckless Driving | $200 | $180 |

| At-Fault Accident | $250 | $220 |

| Driving Without Insurance | $220 | $210 |

A DUI will raise rates the most at both companies. Accidents and tickets will also raise rates at State Farm and Progressive.

Enter your ZIP code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

Progressive vs. State Farm Car Insurance Coverage Options

When it comes to the basic coverage types at Progressive vs. State Farm insurance, consumers will find that State Farm covers all the bases for legal mandates, as well as the additional coverage lenders may require for financed vehicles; whereas Progressive goes a little beyond, offering extra coverage choices like rideshare insurance that consumers may find attractive for enhanced protection.

Progressive vs. State Farm Auto Insurance Coverage Options

| Coverage | ||

|---|---|---|

| Liability | ✅ | ✅ |

| Collision | ✅ | ✅ |

| Comprehensive | ✅ | ✅ |

| Uninsured Motorist | ✅ | ✅ |

| Underinsured Motorist | ✅ | ✅ |

| Medical Payments | ✅ | ✅ |

| Personal Injury Protection (PIP) | ✅ | ✅ |

| Roadside Assistance | ✅ | ✅ |

| Rental Car Reimbursement | ✅ | ✅ |

| Rideshare | ✅ | ✅ |

| Gap Insurance | ✅ | ✅ |

| Custom Equipment | ✅ | ❌ |

| Pet Injury | ✅ | ❌ |

Looking at coverage comparisons for Progressive and State Farm, we find that both organizations offer the bodily injury liability and property damage liability coverage that is a legal requirement in most of the 50 states, plus the additional uninsured/underinsured motorist policies required by some states.

Most automobile financing organizations also require borrowers to carry collision and comprehensive insurance.

If you’re involved in an accident, are subject to the forces of nature, or some other unforeseen event, collision and comprehensive help cover repairs.

Brandon Frady Licensed Insurance Producer

State Farm and Progressive also both offer medical payment coverage for the driver and passengers of the insured vehicle to help limit expenses should injuries occur.

Progressive goes a step beyond by providing personal injury protection (PIP). Similar to medical payment coverage, personal injury protection offers no-fault coverage for injuries experienced by the driver or passengers of the insured vehicle, no matter the reason or fault for those injuries. You can get quotes from Progressive to determine your exact rate for these coverages.

This can be especially important if struck by an uninsured motorist or involved in a hit-and-run accident. Additional coverage levels are also available from State Farm and Progressive.

Read More: How do I know if I chose the right coverages?

Both organizations offer coverage for towing and labor in the event of a damaged or stranded vehicle, as well as rental reimbursements if insured motorists are without their cars for some time. Progressive again goes a step further with optional coverage choices by providing protection for the car’s sound system, as well as vet bills if an animal in the vehicle becomes injured during an accident.

Progressive vs. State Farm Car Insurance Discounts

Many different factors play into the costs that consumers pay for their automobile insurance policies, from the type of car to their driving record, to what other insurance types they carry.

Most companies offer discounts for good habits and safe driving histories, which can considerably help lower insurance premiums. However, this doesn’t necessarily mean that they offer the lowest rates, as base rates before discounts also vary by state and between carriers. Take a look at the list of Progressive and State Farm discounts below.

Progressive vs. State Farm Auto Insurance Discounts

| Discount | ||

|---|---|---|

| Multi-Policy | 10% | 17% |

| Multi-Car | 12% | 20% |

| Safe Driver | 12% | 20% |

| Good Student | 10% | 35% |

| Distant Student | 10% | 20% |

| Homeowner | 5% | 4% |

| Continuous Insurance | 10% | 8% |

| Defensive Driving | 30% | 15% |

| Teen Driver | 7% | 18% |

| Anti-Theft Device | 25% | 15% |

| Paperless/Online Discount | 4% | 3% |

| Pay-in-Full | 15% | 15% |

| Automatic Payment | 12% | 13% |

| Low Mileage | 30% | 30% |

When you compare Progressive and State Farm in terms of discounts offered, which vary slightly by state, Progressive has the edge, with greater savings for its prospective insured drivers and for any others who drive their vehicles. However, both companies offer great deals for young drivers, with good student discounts.

Both companies also offer discounts for bundling policies like home and auto insurance (Read More: The Best Companies For Home and Auto Insurance Bundles). Just make sure to read up on Progressive vs. State Farm home insurance reviews before committing.

Safe Driver Discounts at Progressive and State Farm

Both Progressive and State Farm offer apps that track driving behaviors before awarding a safe driver discount.

Progressive’s app is called Snapshot, and it claims to save drivers up to an average of $231 per year. However, bear in mind that Progressive may raise rates if drivers do poorly in the program.

On the other hand, State Farm’s program is called Drive Safe & Save, offering a discount of up to 30% for good driving habits.

State Farm also offers a teen driving app called Steer Clear for drivers under age 25. It provides training to young drivers on how to drive safely and tracks behaviors before awarding a discount. State Farm also offers some great deals on car insurance for young drivers outside of Steer Clear, like its student away discount.

If you’re a young driver, State Farm’s programs and discounts can help you score lower car insurance rates (Learn More: Best Car Insurance for Young Drivers).

Customer Reviews of Progressive and State Farm

Both Progressive and State Farm have feedback from customers on sites like Reddit, Google, and Yelp. For an idea of what customers are saying, read through the Reddit thread below.

Some customers recommend State Farm over Progressive because State Farm assigns each customer a local agent who can be more personable when filing claims or making changes.

Read More: Best Car Insurance Agents & Brokers

However, most customers say that either company is fine, as both are large, reputable companies, and to choose whichever offers the better deal.

Enter your ZIP code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

Business Ratings of Progressive and State Farm

As you compare Progressive vs. State Farm, seeing how customers experience service from either company should factor just as highly into your decision-making process as their coverage availability and costs.

You’ll likely interact with your chosen insurance company not only when you make payments and renew your coverage, but also to file claims when necessary due to damage or accidents.

Understanding how others rank different insurance carriers can help you make the best choice for your own coverage.

Insurance Business Ratings & Consumer Reviews: Progressive vs. State Farm

| Agency | ||

|---|---|---|

| Score: 672 / 1,000 Below Avg. Satisfaction | Score: 710 / 1,000 Avg. Satisfaction |

|

| Score: A+ Excellent Business Practices | Score: A+ Excellent Business Practices |

|

| Score: 72/100 Avg. Customer Feedback | Score: 75/100 Positive Customer Feedback |

|

| Score: 1.11 Avg. Complaints | Score: 0.84 Fewer Complaints Than Avg. |

|

| Score: A+ Superior Financial Strength | Score: A++ Superior Financial Strength |

In the 2017 J.D. Power U.S. Auto Claims Satisfaction Study, State Farm and Progressive rank similarly across the seven surveyed areas. Despite being industry-leading agencies, both insurance companies rank squarely in the middle.

Both State Farm and Progressive were awarded 3 out of 5 stars in the first three surveyed factors of Overall Satisfaction, First Notice of Loss, and Claim Servicing.

In the fourth, Estimation Process, State Farm rated 4 stars to Progressive’s 3 stars. For Repair Process and Settlement, each garnered 3 of 5 stars, while Progressive led State Farm 4 stars to 3 in the Rental Experience results.

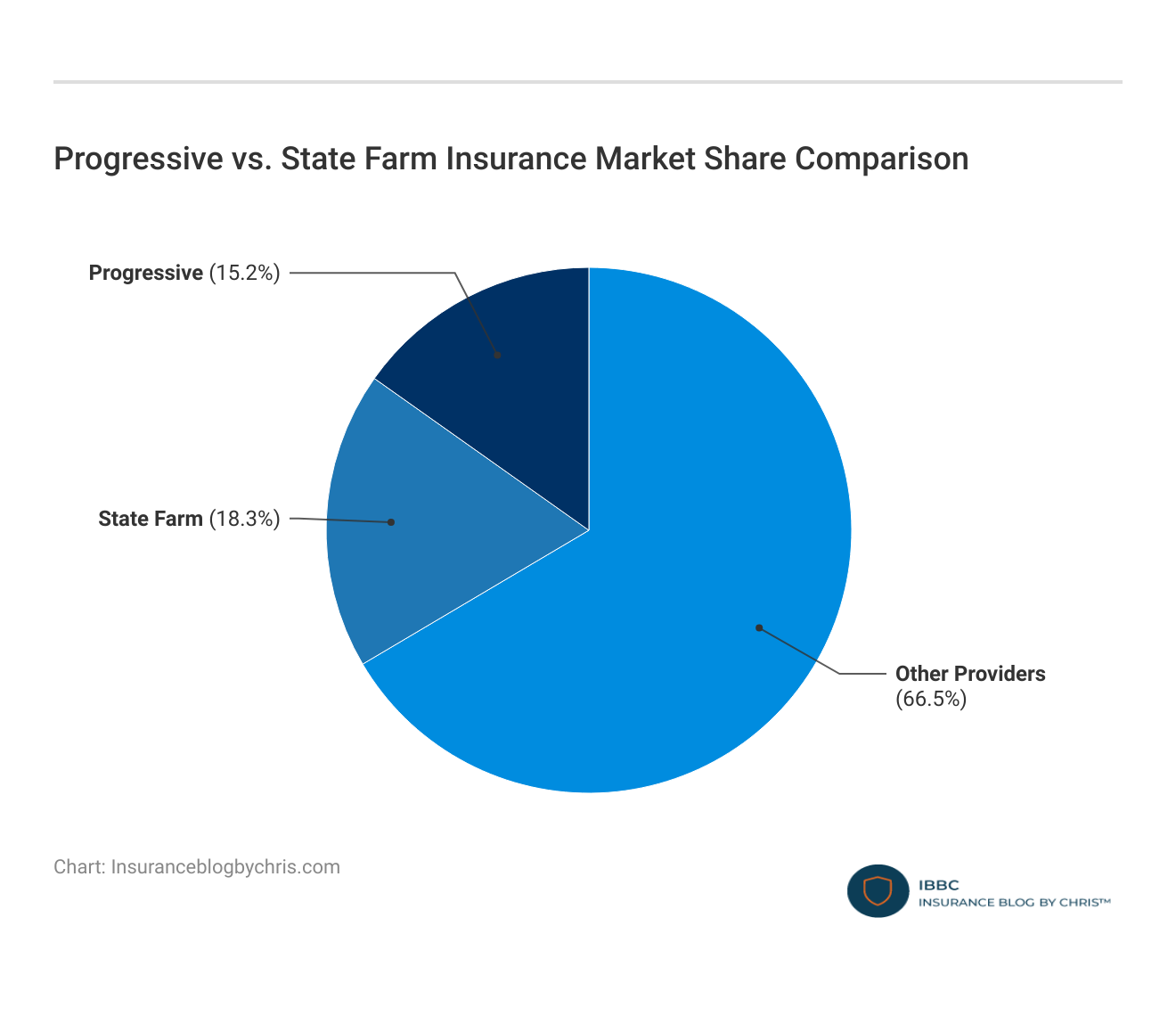

Additionally, Progressive and State Farm are giant insurance carriers that insure more individuals, leading to statistical results across a broader spectrum.

When we compare Progressive vs. State Farm, both companies score in the lower-to-middle end of the results for the J.D. Power Auto Insurance Study on Overall Satisfaction, policy offerings, price, billing process and policy information, interaction, and claims in California, earning 3 of 5 stars in each category in that region.

- In Florida, Progressive bests State Farm with 3 of 5 stars in all but Claims, where it earned 2 of 5 stars. By comparison, State Farm rated just 2 of 5 stars in each category in Florida.

- In New York, the companies again essentially tied with 2- or 3-star ratings in each category. In every region, brands with just as much name power, such as Allstate, USAA, and MetLife, performed better than Progressive and State Farm (For more information, read our “Progressive vs. Allstate: What’s the Best Coverage & Rates“).

As enormous entities, Progressive and State Farm operate under a number of subsidiary names depending on the state or region. With the national median ratio set at 1.00, you can see that both companies scored higher than average.

However, Progressive was much closer with a 1.11, and State Farm had more than double the ratio with a 2.58, which reflects the 9,444 complaints in 2016.

Comparing Financial Strength

The financial strength and stability of an organization should also be considered in your decision-making process because they may impact how quickly and adequately your needs are met in the event of a large-scale disaster.

Several organizations evaluate the financial strength of insurance companies, including A.M. Best, Moody, Fitch, Kroll Bond Rating Agency, and Standard and Poor’s.

Progressive Insurance has earned an A from A.M. Best, A2 from Moody’s, and A from S&P–essentially the highest or very high ratings from each service. Comparatively, State Farm earned an A++ from A.M. Best and an AA from S&P.

Learn More: Find The Best Auto Insurance Company For You

With each company earning very high marks from financial rating agencies, consumers should feel comfortable that either entity will treat their insurance premiums responsibly and respond appropriately in the customer’s time of need.

Progressive Pros and Cons

Pros

- Name Your Price Tool: Progressive offers a free budgeting tool called Name Your Price. It helps customers calculate how much coverage they can afford.

- Financial Stability: Progressive has an A+ rating from A.M. Best for financial management.

- Coverage Variety: Progressive offers a range of coverage options, from custom parts coverage to roadside assistance.

Cons

- Snapshot Rate Increases: Poor app performance could actually lead to higher rates for a driver (Learn More: Best Car Insurance for Bad Drivers).

- Few Local Agents: Progressive has fewer agents available locally, so most communication with the company will be remote.

State Farm Pros and Cons

Pros

- Teen Driving Program: State Farm’s Steer Clear discount program is great for families with young drivers under 25 (Read More: The Best Car Insurance For Parents Of Young Drivers).

- Local Agents: State Farm agents are stationed throughout the U.S., allowing customers to receive more personalized assistance with their policies.

- Customer Satisfaction: State Farm has an 877 / 1,000 score from J.D. Power, which is above average.

Cons

- Fewer Coverage Options: State Farm has fewer options than Progressive, lacking custom parts coverage and pet injury coverage.

- May Reject High-Risk Drivers: State Farm may not insure as many high-risk drivers as Progressive does.

Enter your ZIP code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

Comparing Progressive vs. State Farm’s Car Insurance

When you’re considering Progressive vs. State Farm car insurance, keep in mind that both are some of the best car insurance companies with stellar reputations, who have been servicing drivers for many years.

Progressive was founded in 1937 and has made innovation the center of its services for more than 80 years. State Farm shares an equally impressive and lengthy history, servicing 44 million auto policies.

If you’re deciding between Progressive or State Farm for your auto insurance policy, it’s important to spend adequate time thoroughly researching both organizations and the types of coverage they provide, in order to get the best insurance for your needs. To widen your search, enter your ZIP in our free tool to find the cheapest company in your area.

Frequently Asked Questions

Does State Farm own Progressive?

No, State Farm does not own Progressive Corporation. They are two entirely different companies that are not affiliated with each other.

Is Progressive or State Farm cheaper?

State Farm Insurance is cheaper, with rates starting at $33 per month, compared to Progressive’s starting average rate of $39 per month. Find cheap car insurance today with our free quote tool.

What are the Progressive good student discount requirements?

The Progressive good student discount requirements require students to be under 23 years old and have a minimum B average (Read More: Best Car Insurance For Young Adults).

What’s better, Progressive or State Farm?

When choosing between State Farm or Progressive, State Farm is usually the cheaper option, with rates starting at $33 per month. However, Progressive has more coverage options and usually insures higher-risk drivers.

Does State Farm pay out claims well?

Yes, State Farm Mutual Automobile Insurance Company has an average satisfaction score of 710 / 1,000 for claims satisfaction from J.D. Power.

How can I qualify for a Progressive Insurance defensive driving discount?

You will have to successfully complete one of the approved courses from Progressive and submit evidence of passing to qualify. This discount is not available in every state, so check with your agent beforehand (Learn More: Best Car Insurance for Good Drivers).

Is Progressive good at paying claims?

Progressive has a satisfaction score of 672 / 1,000 for claims satisfaction from J.D. Power, which is slightly below average.

Is there a Progressive rental car discount?

Yes, Progressive members can receive discounts when renting cars from popular car rental sites through Progressive’s PerkShare.

How can I qualify for a student away discount at State Farm?

To qualify for the State Farm student away discount, you need to be under 25, attend school over 100 miles from home, and only drive the vehicle when home during break. The car can not be taken to campus (Read More: Best Car Insurance For College Students).

Does Progressive raise your rates after an accident?

Yes, Progressive Casualty Insurance Company does raise rates after an accident unless a driver qualifies for accident forgiveness.